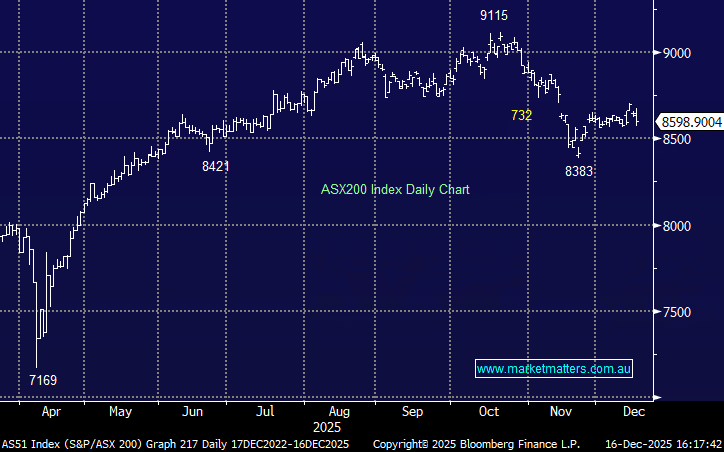

Rare earth stocks have been on a politically driven roller coaster ride over the last 3-4 months which has delivered great returns for the nimble while being particularly dangerous for those who arrived late to the party:

In April, China demonstrated its dominance in the rare earths market when it introduced sweeping export controls on seven key rare-earth elements and permanent magnets, requiring exporters to secure special licences. This move sharply tightened global supply chains. Beijing then reinforced its grip by issuing 2025 mining and smelting quotas only to a select group of state-owned firms, while expanding the quota regime to include imported feedstock. The result was a sharp drop in rare-earth magnet exports, with volumes down nearly 19% and export values falling almost 30% in the first half of 2025. Prices spiked, supply chains were disrupted globally, and crucially, the West was forced to accelerate its strategic response.

- In early August, rare earth stocks started to rally as supply concerns emerged after MP Materials halted raw material shipments to China, tightening the availability of neodymium and praseodymium (NdPr) for processing. Prices for high-demand rare earths such as NdPr and dysprosium surged, boosting optimism among investors and mining companies.

- In late August, weak downstream demand in China and other markets caused some traders to scale back purchases; speculative buying slowed, and prices dipped 5-10%.

- From late September, prices drove higher for 3-4 weeks on renewed geopolitical tensions, export restrictions, and strategic demand for EVs and clean-energy applications, reigniting buying interest, sending Neodymium oxide and praseodymium prices surging +10 to 15% in a few volatile weeks.

- However, since mid-October, prices have crumbled on a tentative U.S.–China trade/truce deal, reduced fears of prolonged Chinese export restrictions, which had previously supported higher prices, sending neodymium and praseodymium (NdPr) down ~13% over the past month.

Rare earths are largely an over-the-counter (OTC) commodity, not exchange-traded, leading to lower transparency and often elevated volatility. Today, prices remain elevated compared to earlier in the year, but another leg higher is likely to depend on sustained demand, tightening supply, and clear downstream uptake rather than just headline shocks, unless, of course, China and the US relations again deteriorate.

This morning, we’ve revisited 5 options to invest in rare earths, both on the ASX and in the US.