The US Real Estate Sector led equities higher overnight as pressure reduced on bond yields; the sector finished up +2.5% while the IT Sector actually closed lower. With investors struggling to justify the lofty valuations of many well-known stocks, the real estate names offer a degree of solace as they remain ~25% below their 2021 high, and interest rates looked to have peaked with the main question of when and how fast will the Fed cut as opposed to if they will cut.

- We remain bearish bond yields in the medium term, which bodes well for rate-sensitive stocks such as real estate.

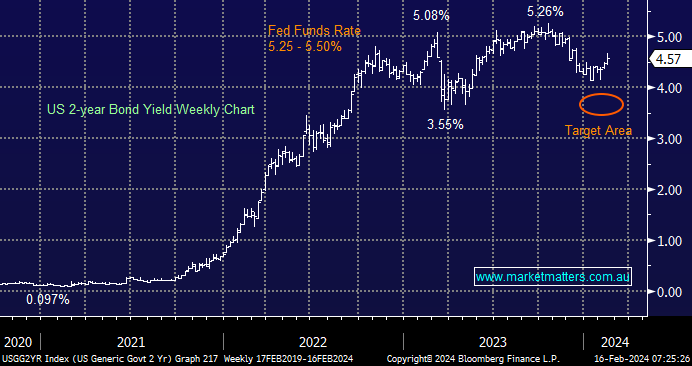

US bond yields popped higher earlier in the week following the CPI print, but after the 2s had retreated almost 1.25% from their 2023 high, we felt it was more like the market taking a rest as opposed to threatening the move. Credit markets appear to have adjusted to rates falling slower/later than were hoped in January. Still, ultimately, we believe they are going lower, which should lead to some performance catch-up by the stocks/sectors that have been under pressure since the aggressive hiking cycle began in early 2022.

- We remain bearish bond yields in the medium term, targeting the 3.5% area for the US 2s.

This morning, we have briefly revisited three local real estate stocks that performed strongly yesterday as we consider if/where we may consider increasing our exposure, especially following the impressive report from Goodman Group (GMG) yesterday, which propelled the stock up +7% to fresh all-time highs:

- We summed up our view on GMG perfectly yesterday, “A great result from a great operator, nothing to do here but stay long.” – MM has a 4% position in GMG in our Active Growth Portfolio.