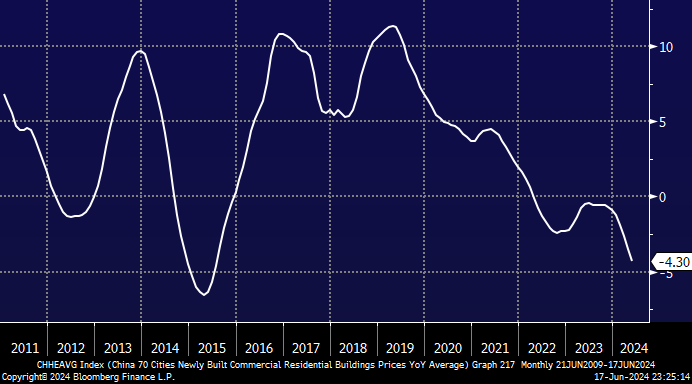

China’s housing crisis deteriorated in May, triggering further calls for Beijing to support the important economic area. Yesterday’s data was the worst since 2011. The property market has weighed on China’s economic growth for years, and yesterday saw declines in real estate investment and home prices gather pace. Also, industrial production missed expectations for May, rising 5.6% from a year earlier but slowing from April. The only encouraging light on Monday was Retail Sales improving faster than expected, but the net result is China is still experiencing a weak economic recovery, with Beijing needing to step up if it’s going to achieve its 5% growth target.

Property remains the key at this stage, with Beijing’s initial supportive measures failing to gain traction, but as we know, when Xi Jinping commit to something, they tend to follow through. The PBOC kept interest rates unchanged for the 10th consecutive month on Monday and while there’s room to cut to help housing, a weak Yuan is also an issue for the central bank. The Chinese economy is like a children’s seesaw at present, with exports and energy-related capex being offset by weak property and consumption.

Most important for the ASX is how/when Beijing will arrest the decline in their Property Sector because a buoyant housing market consumes huge amounts of commodities such as iron ore and copper. We believe it’s important that Beijing has already made its intentions clear and it intends to stem the decline in housing; recently, it relaxed mortgage rules and encouraged local governments to buy unsold homes. The results haven’t been fast, but further levers are at Beijing’s disposal as they look to instigate a targeted response. Interestingly, the markets are in a “glass half-empty” mood at present; in previous years, poor data was welcomed because it was expected to lead to further stimulus, but today, it is now being regarded as a failure by Xi Jinping et al.

- We believe Beijing will ultimately support its property market just like they crushed speculators a few years ago.

- Subscribers should remember that things look their worst at extremes.

Chinese stocks slipped only 0.2% on Monday, but the embattled Chinese Developers fell over 3% into the afternoon following the economic releases. However, the pullback by Chinese stocks is constructive and one we have been targeting through May/June.

- We like the risk/reward towards the China Shenzhen Index ~3500, which implies the downside is limited for their embattled Property Sector.

One of MM’s global views is that China will ultimately turn around its embattled property market, but it’s akin to an oil tanker as opposed to a speedboat, i.e., it takes time. At this stage of the cycle, Beijing has lost the confidence of markets that it can influence property prices, but people’s memories are short. A few good numbers and the turnaround bandwagon will be back in town.

However, as we head into the EOFY and China’s property market continuing to deteriorate, its hard to envisage an aggressive turnaround in the next few weeks.