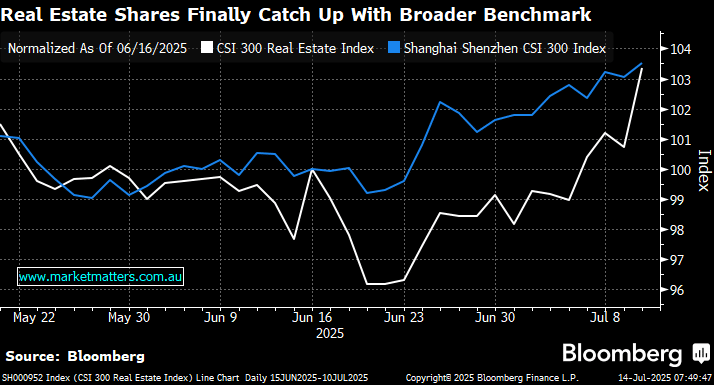

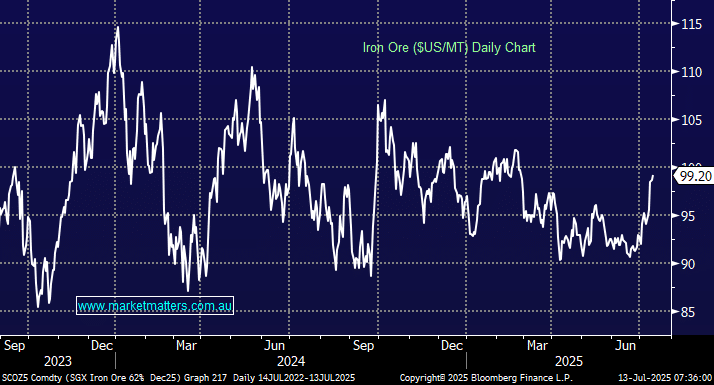

China housing stocks surged higher last week in anticipation/hopes of another property rescue package. We can see policymakers move to stabilise the embattled property sector, but the “bazooka style” stimulus is unlikely, with targeted and tailored moves being the preferred path for Beijing. The Chinese government is showing signs of taking action to arrest deflation in the world’s second-largest economy, and as we saw last week, any glimmers of hope for the property sector translate to higher prices for iron ore.

The bulk commodity has struggled to hold onto the psychological $US100/MT level through 2025, fearing increased supply and lacklustre demand. Still, the markets are bearish, which could result in outperformance on the upside on just glimmers of strength, as we saw last week.

- Iron ore has bounced ~10% from its June low in anticipation of further Beijing stimulus; if these gains are maintained or extended, upgrades may flow through related stocks.