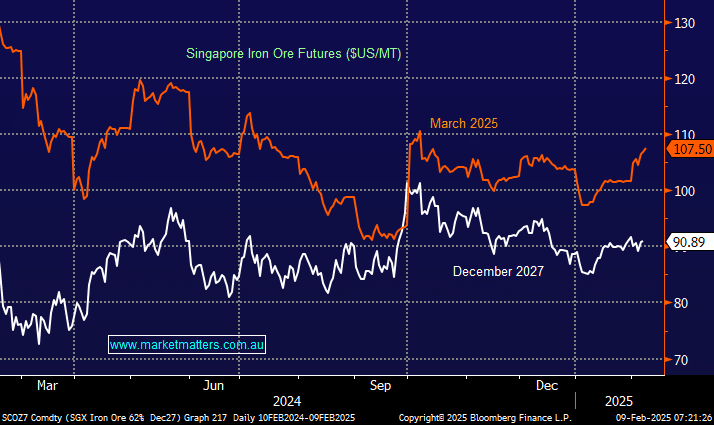

Iron Ore (Fe) is a very influential commodity on the ASX, and while analysts are bearish on the bulk commodity, especially in the second half of 2025, it has proven resilient so far. Iron Ore Futures prices are trading well below today’s spot price for March, which closed above $US107 in Singapore; for example, December 2027, Fe was trading just above $US90/MT on Friday, a more than 15% discount – this condition is called backwardation.

- Backwardation occurs when the current price of an underlying asset is higher than the prices trading in the futures market. In the case of Fe, this is primarily because increased supply is expected into a vulnerable market in the second half of 2025.

- The opposite condition is called Contango, when the price of a commodity in the future is higher than its current price, illustrating the expectation of demand outstripping supply into the future.

We believe analysts are too bearish about the bulk commodity, which will ultimately result in upgrades for heavyweights BHP, FMG & RIO.