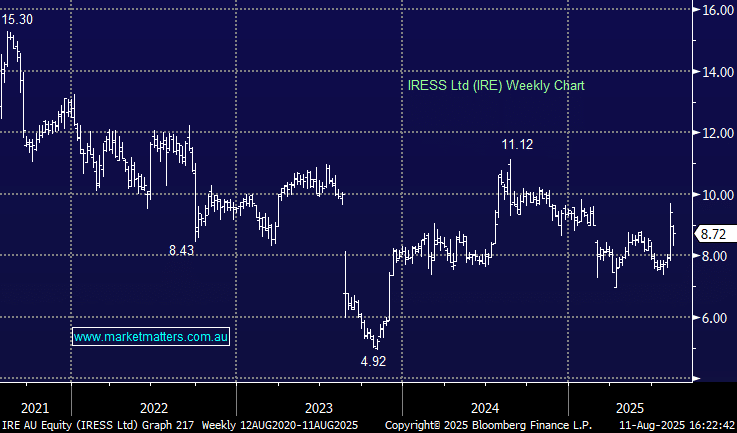

IRE –7.23%: posted a FY25 result that showed stronger-than-expected revenue growth in continuing businesses (+6.8%) but a softer earnings after higher than expected R&D spend.

- Earnings of $64.4m came in below consensus at $65.5m.

- Guidance for FY26 EBITDA of $127–135m maintained.

A topsy turvy set of trading sessions with the stock up +10% on Friday before being pulled back down today. The $1.9bn Blackstone and Thoma Bravo buyout discussions around $10 a share certainly makes things interesting but the market is sceptical after the result. As users of the platform, we can’t see the R&D spend translating into improved user experience from our end, with most of the focus on the Super segment.