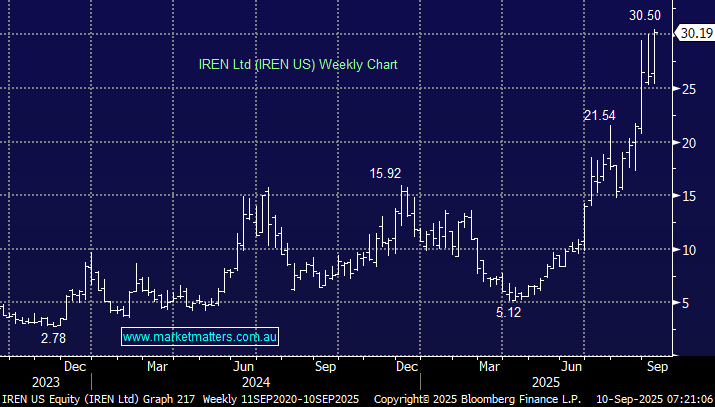

Sydney-based and US-listed Bitcoin miner and data centre operator IREN Ltd (IREN US) continues to impress on execution, but after a strong run, we think the valuation is starting to look a bit full. When we originally took a position in June, we held the view that given strength in earnings, they could easily justify an earnings multiple of 20x, implying the stock was worth around $19 relative to the ~$12 at the time. With IREN having blown through our initial assessment as they continue to market their success to a wider audience, it has blown out to an earnings multiple of 29x. In other words, the recent explosive rally has been driven entirely by an expansion of the multiple rather than a material change in expected earnings.

29x for an exciting business in a growth area that is increasing earnings strongly is not unreasonable, though the nature of what they do is higher-risk. At its core, IREN is funnelling earnings from Bitcoin mining into building next-gen, AI-focused data centres powered entirely by renewables – a compelling long-term narrative, but not a simple model.

Overnight, they released their August update with the stock rallying on the back of continued AI momentum and a CFO appointment from Macquarie. That said, the Bitcoin side of the business showed some softening, with 668 Bitcoin mined vs 728 in July, seeing mining revenue down m/m to $76.7m vs $83.6m and profit margins off 6% to 66%. This is the first real monthly dip in mining performance in some time. While not unexpected – Bitcoin mining is volatile and sensitive to both price and power costs – and it should serve as a reminder that this is a cyclical, capex-intensive business, with multiple moving parts.

On the flip side, their AI cloud revenue continues to ramp, albeit from a low base, increasing to $2.4m in August with a standout 98% hardware profit margin. More importantly, IREN is preparing to take delivery of ~9,000 Nvidia Blackwell GPUs, with a total 10,900 expected to be deployed, with their designation as a Nvidia Preferred Partner supportive of ongoing access to chips – two pain points that have hampered other AI infrastructure players.

IREN’s share price has been strong, and rightly so – the business is executing well, with no debt, healthy operating leverage, and visibility around both Bitcoin and AI revenues. However, we think we’re now moving into the zone where the risk/reward is no longer skewed as positively.

- While we like the IREN story and continue to see structural tailwinds over the longer term, the stock now looks expensive on near-term fundamentals. Our position is up over 150% in less than 3-months, and we’re now likely to take this and move down the risk spectrum as it trades to new highs.