IPX is a U.S.-focused critical minerals company developing low-carbon titanium metals and powders (rare earths) from its Tennessee project and recycling technologies for use in aerospace, EVs, 3D printing, and defence – several “hot” areas here. This $2.2bn business is pre-revenue, but at the end of June, it reported holding $US55 million in cash, positioning the company well to continue scaling its operations at the Titanium Manufacturing Campus in Virginia. The company might be burning cash, but it doesn’t appear to be an issue moving forward:

- In July, IPX announced a private placement of 14 million new ordinary shares at an issue price of A$5.00 per share. This placement is expected to raise approximately US$46 million before costs, resulting in pro-forma cash of approximately US$100 million.

- Plus, in August, they received $US12.5mn in US Department of Defence funding for titanium production.

The company intends to use the proceeds from the placement to accelerate Phase 2 capacity scale-up, fast-track ordering of long lead time production and manufacturing equipment, scale Phase 1 operations, and support Phase 3 expansion studies and increased R&D. Importantly, looking just a little further ahead, IPX is expected to generate $3.4mn in FY25 and $44.1mn in FY26 and significantly more in FY27 as it flicks the proverbial switch.

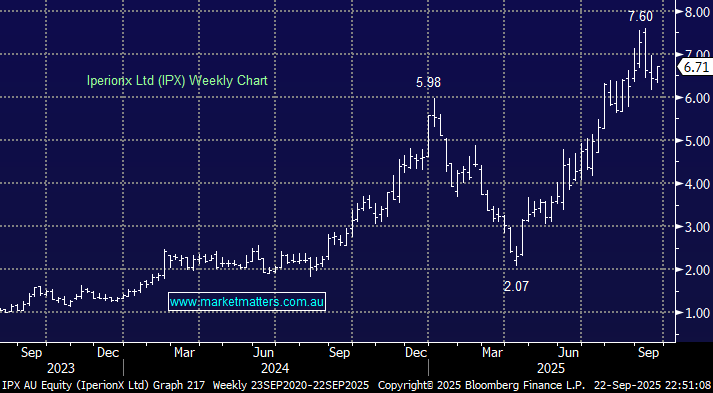

- We like IPX, but it’s run hard and we can see it trading between $6 and $8 into 2026.