The Australian three-year bond yield recovered some of its recent early losses last week. It remains a big ask for them to push much below 4% without clear signs that inflation is under control and the RBA has donned a dovish hat into 2024 – this week’s Retail Sales and monthly CPI (inflation) data will influence how Australian bonds and interest rate hopes travel into 2024.

- We continue to look for Australian short-dated yields to eventually re-test 3% in 2024/5 but acknowledge such a move will require an accommodative stance by central banks.

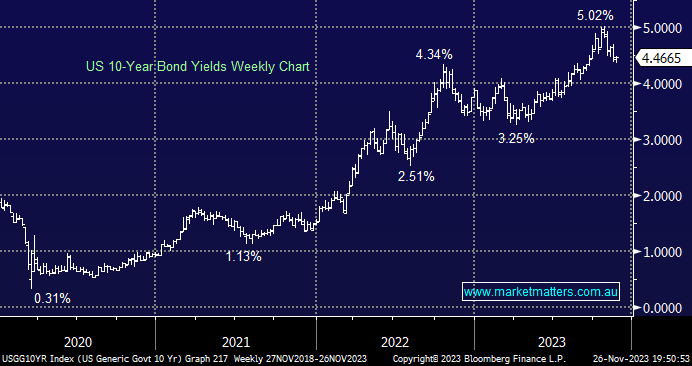

The US 10-year yield ended last week flat after retreating ~0.5% through November, an encouraging move to support our dovish outlook. However, similar to our yields, we will need more concrete evidence that the inflation genie is back in the bottle before markets push them significantly below the Fed Funds Rate, which currently sits between 5.25% and 5.5%.

- No change; we are still initially targeting a retest of the 4% area through 2024, but ultimately, lower levels wouldn’t surprise.