The Australian three-year bond yield retreated last week following the market-friendly US CPI inflation print, as signs emerge that the macro factor, which has sent interest rates soaring over recent years, is finally under control. The local 3s have gone from testing 4.5% to almost 4% in 3-weeks, fuelling the recent strong rally by equities. We are looking for an initial test of 3.75% into Christmas, but money markets will need to be convinced that rates are set to be cut in 2024 before they push them much lower, with the cash rate sitting at 4.35% after this month’s hike by the RBA.

- We continue to look for Australian short-dated yields to eventually re-test 3% in 2024/5 but acknowledge such a move will require an accommodative stance by central banks.

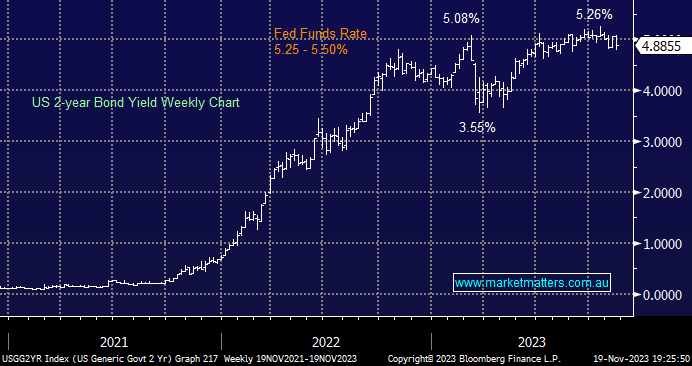

The US 2-year edged lower last week following the CPI number, but similar to our own short-dated yields, it’s going to need more concrete evidence that the inflation genie is back in the lamp before markets push them much further below the Fed Funds target band which currently sits between 5.25% and 5.5%.

- No change; we are still targeting a retest of the 4% area through 2024 – a similar pullback to that experienced in late 2022.