The Australian three-year bond yield closed unchanged last week after an early foray up towards 4.5%; with the RBA decision looming tomorrow afternoon and bets increasing that Michele Bullock & Co. will hike, it’s likely to be quiet in local bonds until 2.30 pm tomorrow, just 30-minutes before the start of the Melbourne Cup.

- No change; we continue to look for Australian short-dated yields to eventually re-test 3% in 2024/5 but acknowledge such a move will necessitate rate cuts.

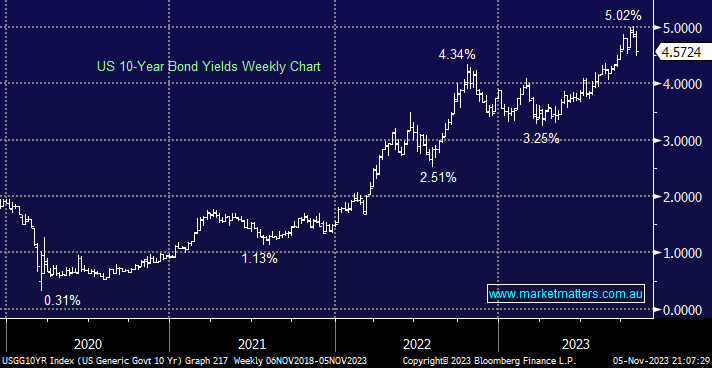

The US 10-years reversed sharply last week after the Fed left rates unchanged and delivered a relatively dovish speech. Weak employment data during the week also helped push yields lower, it’s not a “lay down misère”, but we believe yields have topped out, which is supportive of equities into 2024.

- No change; we are still targeting a retest of ~4.25% over the coming months, with the RBA decision likely to set the foundations into 2024.