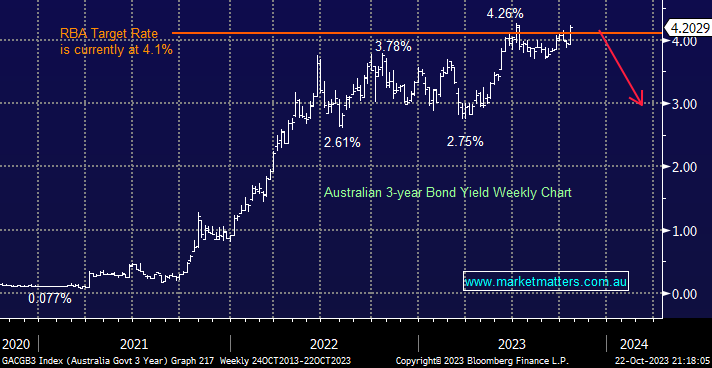

The Australian three-year bond yield rallied back above 4% last week after the RBA and Fed made it clear further rate hikes are not out of the question. At this stage, we need to see them back below 3.75% before becoming confident that our forecasted decline is underway.

- No change; we continue to look for Australian short-dated yields to eventually re-test 3% in 2024.

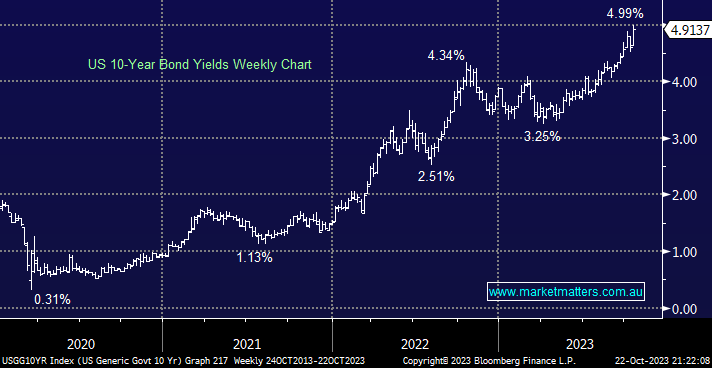

US 2-years made new multi-year highs last week following comments from the Fed, but interestingly, they closed on their lows unchanged as the “safety bid” appeared to get the better of the hawkish central bank. The “2s” have danced around the 5% level since early July, and we see no reason to fight this equilibrium until further notice.

- We are still targeting a retest of ~4% through 2024 by the 2s but for now they are comfortable ~5%.