The Australian three-year bond yields jumped back above 4% last week and are set to test their 2023 high this week following last night’s hawkish comments from the Fed. Australian markets are continuing to take their lead from the US, which is weighing on bond prices and pushing yields higher, the trend is strong and backed by an inflationary macroeconomic backdrop. We have been looking for rates to top out, but there are no signs yet – at Michelle Bullock’s first RBA rate announcement at 2:30 pm today, we expect no change, i.e. the local cash rate to stay at 4.1%.

- No change; we are looking for Australian short-dated yields to re-test 3% into 2024 – a long way off at the moment!

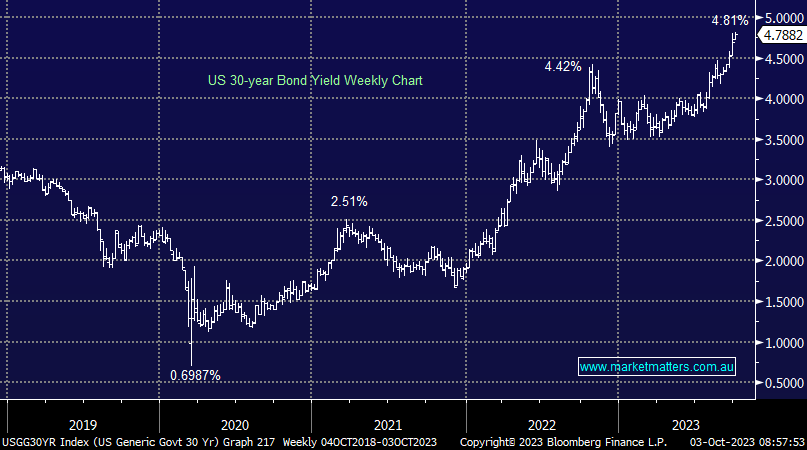

The Fed continues to maintain a hawkish stance, effectively talking bonds down/yields higher, which we believe makes sense, they will want to see a clear runway to lower inflation before contemplating cutting interest rates. However, short-dated US yields have remained below this year’s 5.2% high, suggesting markets are accepting the higher for longer narrative, but they aren’t at this stage expecting further hikes into Christmas.

- We believe that the Fed is staying hawkish while they await a clear picture of inflation. Ultimately, we can see the long-dated 30-years back toward the 3.5% area.