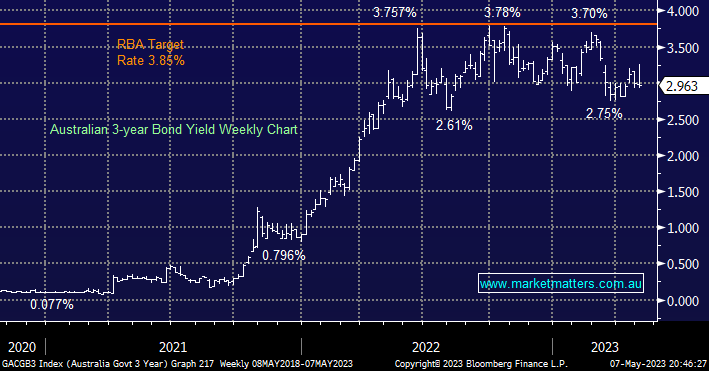

Even following the surprise +0.25% hike by the RBA last week we saw Australian 3-year bonds close lower for the week on Friday with CBA who were the only main bank to call a hike now believing rates have peaked and cuts are a distinct possibility later this year i.e. by definition they must have a very subdued opinion of our economy over the next 6 months.

- We believe local 3-years will test 2.5% over the coming months but the downside is likely to be limited with plenty of economic weakness already built into prices.

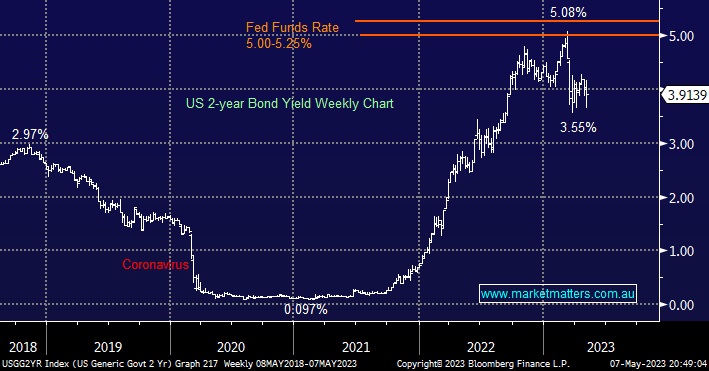

US 2-year Bonds have continued to consolidate their recent gains over the last month (yields lower) as recession fears grow but similarly to local markets, we feel there’s now a lot of bad news already built into yields making it hard to envisage a major move under 3.5% until we see a distinct change in rhetoric from the Fed &/or worsening of the US economic outlook.

- We believe US 2-year bond yields are now set to rotate around the 4% area following a similar path to the local bond market, however, in the short term the risks are skewed slightly to the downside.