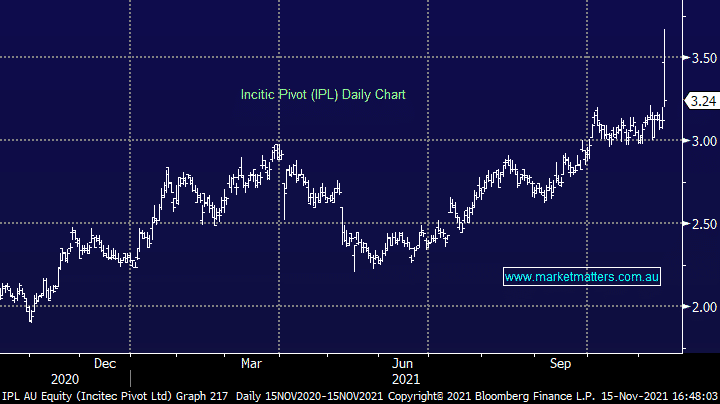

IPL +3.85%: Shares in the fertilizer & explosives business shot out of the range today, trading to 24 month highs early before giving up most of the gains. The FY21 result was out this morning which saw adjusted EBIT rise 51% to $566m with market leading explosives tech and surging fertilizer prices contributing to a strong 2nd half and a beat at the result. They flagged strong commodity prices with spot ammonia currently more than double last year’s average price. They managed to post the strong growth in earnings despite continued production issues, Incitec are confident these issues are behind them and the WALA plant should run to nameplate capacity this year.

scroll

Question asked

Question asked

Amplify Lithium & Battery Technology ETF (BATT US)

Amplify Lithium & Battery Technology ETF (BATT US)

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Global X Battery Tech & Lithium ETF (LIT US)

Global X Battery Tech & Lithium ETF (LIT US)

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Related Q&A

Thoughts on why IPL keeps falling?

Does MM like IPL under $3.50?

Relevant suggested news and content from the site

chart

Amplify Lithium & Battery Technology ETF (BATT US)

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

chart

Global X Battery Tech & Lithium ETF (LIT US)

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.