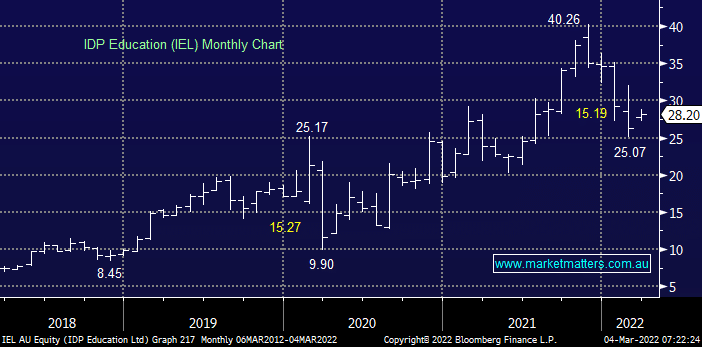

IEL has been hammered over 37% since November making it a standout underperformer as the company has suffered at the hands of both COVID and geopolitical uncertainty. The stock was weak going into last month’s half-year result and the disappointing numbers sent the shares even lower – revenue came in below expectations at $397mn with net profit after tax coming in at $52.9mn. A lack of guidance in today’s uncertain times didn’t help but we really like the education space, it’s just a matter of time before things find a new norm, and buying IEL around current levels is arguably one of the most attractive opportunities to enter the stock in a long time.

We wouldn’t be throwing the kitchen sink at IEL because it remains a high valuation growth stock but it is one of our preferred recovery plays moving through 2022/3.