A number of articles in the press over recent days have been written along the lines of “international students to return on mass in 2023” which should in theory provide a great tailwind for IEL. This student placement / English language teaching company beat earnings expectations this week but the reaction of the stock has been fairly ho-hum. The business impressively placed a record number of students in courses and also conducted a record number of English tests in the period highlighting the swift turnaround from COVID-driven volume declines as gross profit margins also returned to FY18 highs.

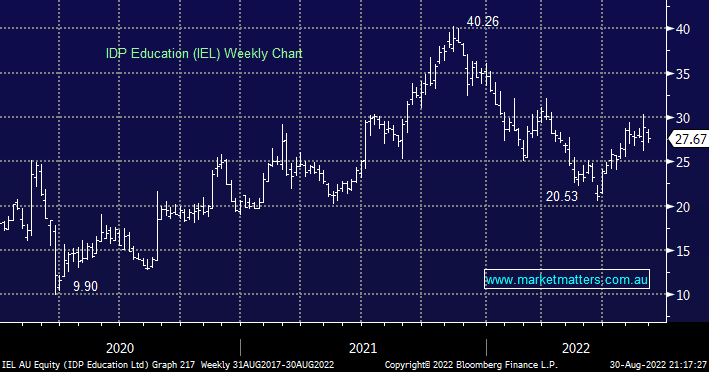

The market’s average reaction was probably because the company didn’t provide any guidance but momentum is clearly improving across the business. However since the market’s aggressive valuation re-rating we caution investors of assuming the next stops at $40 i.e. the stock’s priced for growth an Est P/E valuation for 2023 of 47.4x.

- We are monitoring IEL as it trades more than 40% below its average 5-year premium to the ASX200 industrials i.e. it may prove to be cheap but any COVID relapses will weigh on the stock heavily.

- Also short-term we are cautious as ongoing weakness in the growth/tech stocks following Jackson Hole is likely to weigh on the stock.