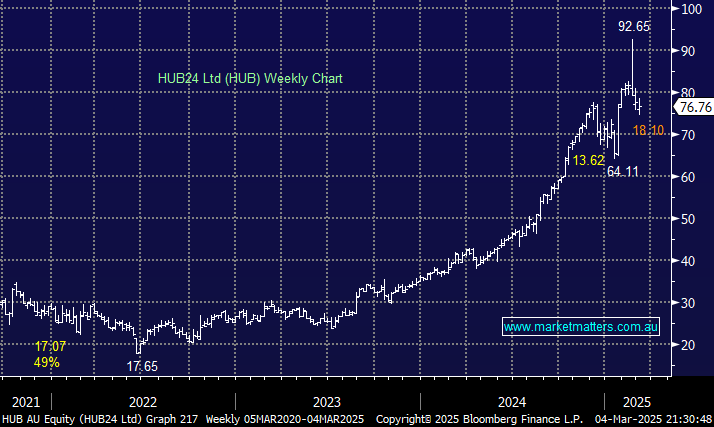

HUB spiked to fresh highs in February following another impressive result, which included a 6% beat to earnings (ebitda) expectations and FY26 platform FUA (funds under administration) guidance upgraded from $123bn to $135bn, significantly above platform FUA at the time of ~$99bn. We do not doubt that HUB is a quality business, but where does the risk/reward favour the buyer after the stock has tripled in the last couple of years? HUB actually received a couple of downgrades following the strong result based on valuation grounds, but after a quick, almost 20% pullback, this concern has improved.

The momentum of funds coming onto the platform is the key indicator we use to assess HUB and momentum has continued into the 2H25, including +$1.5bn of inflows in a typically slower flows period. The upgraded FUA target reflects net inflows and market movements during 1H25. However, as the Trade War drags equities lower, we could see market moves weigh on FUA in the coming months. Conversely, given the strong momentum, MM can see upside risk to flow estimates, especially given that the June quarter is historically seasonally stronger.

Most importantly, HUB continues to demonstrate considerable operational leverage and the numbers tell the story: Operational performance supported 25% revenue growth YoY, with an Underlying EBITDA margin of 39.8%, up 4.7%, as the platform provider controlled costs, demonstrating scale and automation investment are paying off. We believe that HUB has significant room to take funds from established platforms such as BT and Macquarie, but again, some of this likely growth has already been built into HUB’s share price. The rise of independent financial advice and legislated superannuation are two key drivers of flows into the future.

- At MM, we like to buy quality businesses that get caught up in broad market sell-offs; it’s nothing unusual, we get one almost every year.

- We are fans of HUB as a business, and believe its entered an “accumulation zone”.

*Watch for alerts.