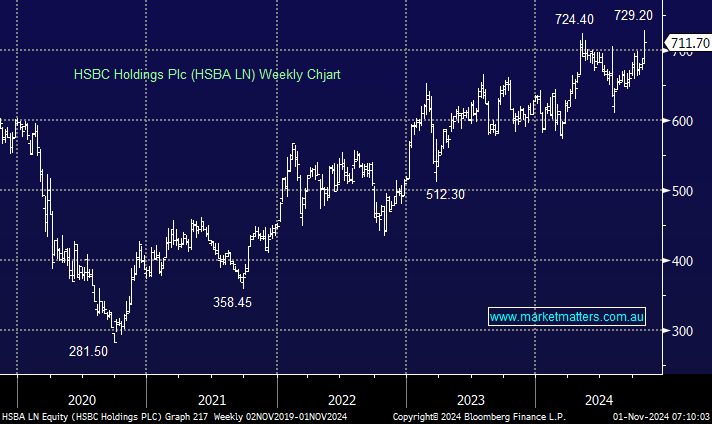

HSBC’s result this week was excellent, but the limited follow-through by the share price illustrates the dangers of buying at this level, at least in the short term:

- HSBC reported a third-quarter pre-tax profit of $8.5 billion, a 10% rise compared to the $7.7 billion posted a year ago.

- Quarterly revenue grew 5% to $17 billion from the $16.2 billion reported a year ago.

As is the case with most stocks looked at today, the businesses are firing on all cylinders, but in the case of HSBC having doubled over recent years, it’s hard to ignore the risks of a 5-10% pullback,

- We like HSBC but are reticent to chase strength as it breaks out to new highs.