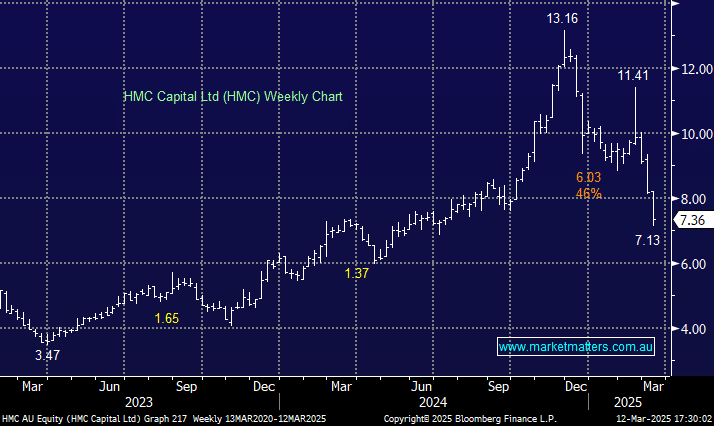

HMC has been a rapidly evolving business over the last few years, and one where a glance at the chart can be misleading, especially the panic buying in November following the $2bn Digico (DGT) IPO. HMC retains an 18.2% holding in the data centre-facing REIT. DGT floated at $5 and closed at $3.86 yesterday, a ~23% decline, illustrating the recent pain in the data centre space. However, the whole AI space has struggled since the success of DeepSeek in China, but after almost halving, HMC is now providing compelling risk/reward.

HMC has also been under intense pressure recently since Healthscope failed to fully pay rent due in March on 11 of its facilities owned by HealthCo Healthcare & Wellness REIT (HCW) – HMC is HCW’s largest shareholder with a 6.24% stake. Healthscope, which US private equity giant Brookfield owns, is weighed down by $1.6bn of debt as hospitals struggle with low visitations and cost inflation. Uncertainty is growing over the future ownership of Healthscope and the 38 hospitals it operates. HMC, run by Di Pilla, has expressed interest in the business, which has led to further weakness in HMC as investors ponder the likely complex nature of any deal, plus the potential need to raise capital. However, we regard it as a positive medium-term if HMC can buy the business at a “bargain price” – buying distressed assets at the right time on the cycle has benefitted many businesses.

- We are bullish on HMC, believing it offers excellent risk/reward below $7.50.