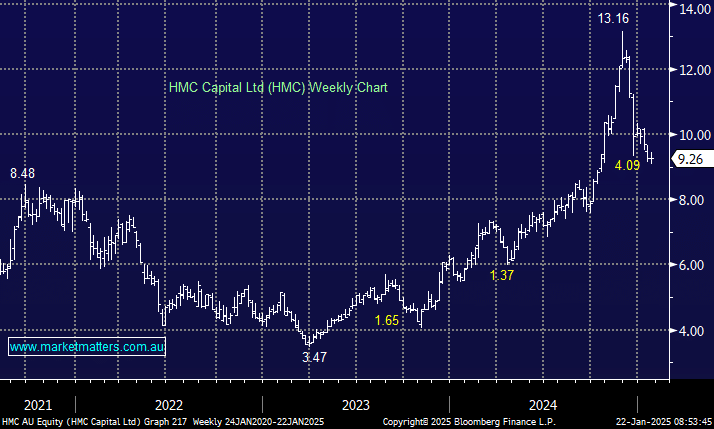

A very hot stock in 2024, with the listed alternative asset manager more than doubling on the back of a string of deals that have grown the scale of their platform and the pool of fees they can earn. The latest transaction was the listing of $2.7bn DigiCo REIT (DGT), which came on the boards last year at an IPO price of $5, closing yesterday at $4.57, though it has been as low as $4.02. The REIT is part of HMC’s Digital Infrastructure vertical, and HMC has retained an 18% stake in DigiCo. While the IPO result is weaker than HMC would have hoped, we think DGT will do well over time with 76 megawatts of installed capacity now and the ability to expand to 238 megawatts.

That said, we see HMC Capital (HMC) as a better way of getting exposure to the more alternative asset space that targets long-term megatrends, with Digitalisation being just one of them.

To that end, there are four areas that HMC are targeting and investing in currently;

- Aging population: Growing and ageing populations, evolving consumer preferences and technological advancement in the detection and treatment of illnesses impacting all developed economies

- Decarbonisation: Investment opportunity of a generation – US$275tn forecast capital investment on energy transition assets globally from 2021 to 2050 to achieve net zero target.

- Digitalisation: Technological advancement driving exponential growth in the digital economy with new digital infrastructure required to meet processing and storage requirements of new technologies

- Deglobalisation: Structural trend driving greater onshoring of key industries including infrastructure, pharmaceuticals, food & energy security, including a significant need to modernise and expand critical infrastructure (including housing) to support growing and ageing populations

They currently have $19bn worth of assets under management (AUM) that is fee earning, up from just $8bn in June 24. Growth has been strong, and we think AUM could potentially increase to $30-50bn over the next 3-5yrs, which is management’s stated target. Putting on our bullish hats, if they got to $50bn of FUM in that time frame, the stock should more than double (we would value it around $25/sh).

While it trades on 20x Est 2025 earnings, which, if compared to traditional fund managers, seems expensive, we think HMC is more like a mini-Blackstone (BX US), a stock we own in the International Equities Portfolio which trades on 31x for FY25. Some of HMC’s expected earnings in FY25 are from unrealised gains, so if we strip those out, HMC is trading on around the same PE as BX, is growing FUM at a quicker rate but is a fraction the size of Blackstone. In any case, there are similarities.

As HMC continues to scale its platform in areas that are growing strongly, with structural tailwinds, we think management, headed by a very experienced deal maker in David Di Pilla (Managing Director at UBS for over 10 years), is in a great position to grow the business over time. The recent pullback in the share price will prove to be a buying opportunity.

- We think the risk/reward towards HMC <$9.50 stakes up, and we are adding it to the Emerging Companies Hit List.