HMC was hit 7% yesterday after Healthscope failed to fully pay rent due for March on 11 of its facilities owned by HealthCo Healthcare & Wellness REIT (HCW). The Healthscope tenancies account for 60% of HCW’s income. HCW is an ASX-listed healthcare property trust managed by HMC Capital, of which, HMC is its largest shareholder with a 6.24% stake. More influential to yesterday’s decline in HMC stock is the well-documented interest that HMC has in buying Healthscope’s Australian hospital business. Healthscope, owned by US private equity giant Brookfield, is in a world of pain, struggling to refinance $1.6bn of debt, as hospitals struggle with low visitations and cost inflation.

If HMC were to have a go, it would be a complex transaction involving other parties, and would likely require fresh equity, however, it would be buying at the right time in the hospital cycle, we think. Brookfield bought Healthscope when private healthcare was booming. They beat others to the party, with strong interest from BGH Capital and AustralianSuper. Brookfield was ultimately successful with a $4.1bn bid. In 2023, Brookfield sold the property assets to HCW for $1.2 billion, independently valued at $1.5 billion in 2024. However, that still left too much debt in Healthscope, which has proved to be an ongoing issue for Brookfield.

On the post-earnings call with HMC Capital in February, HMC managing director for real estate, Sid Sharma was questioned on a potential deal, saying that the pressures in the space are well documented, but volumes are up, VMO (visiting medical officer) retention is high and what needs to be rectified at Healthscope is the capital structure.

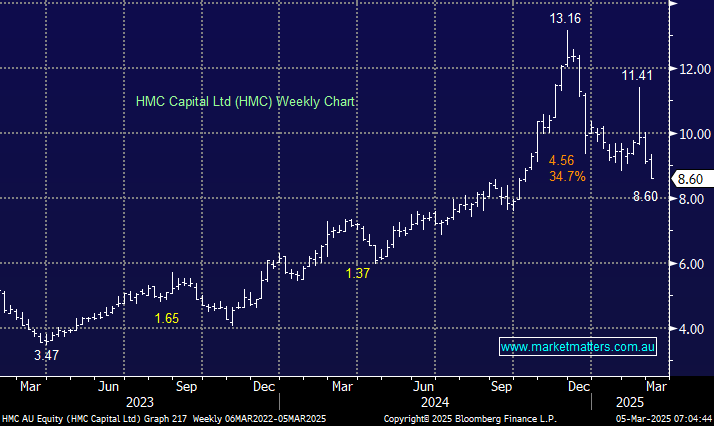

- There is no doubt more to play out here, and that could lead to further weakness in HMC’s share price in the near term. However, if they did pursue a deal, we have little doubt that it would be on very favourable terms—MM owns HMC in the Emerging Companies Portfolio.