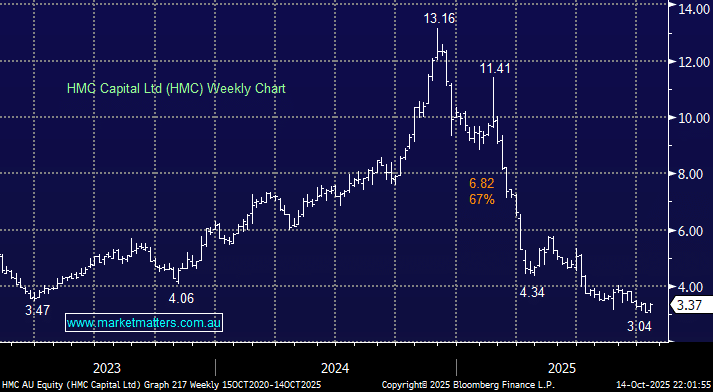

HMC has been a horrible performer over the past year, down nearly 70%, putting it as the weakest performing stock in the ASX 200 (followed by IDP Education, Dominos, Reece, Treasury Wines and Telix). We hold the stock in the Emerging Companies Portfolio, with our initial 5% weighting now down to ~2%.

- The obvious question is whether the chook is cooked or is there a turnaround in the offing?

Their last update (as we wrote at the time) was full of investment banking B/S (excuse our French) with ‘strategic partnerships’ being explored, ‘portfolio optimisation’ under consideration, but the reality is, this is a business that relies on growing funds under management (FUM) i.e. raising money, and raising money is all about confidence. Confidence comes from stability and execution that are in line with stated objectives. They’ve failed at this objective over the past 12 months, having been a market darling before that.

If confidence is important, HMC received a big dose of it last week with Mario Verrocchi, founder of Chemist Warehouse, going substantial, with 5.08% of the company. This is not out of the blue, with Verrocchi having been acquiring stock since early in July and now holding over 20m shares across multiple entities.

The association with HMC and David Di Pilla (HMC CEO) runs deep. Verrocchi is Di Pilla’s uncle, and Di Pilla’s sister Danielle is the Chief People Office at Sigma – SIG (owner of Chemist Warehouse). Danielle has been a big beneficiary of the Chemist Warehouse merger with SIG, owning ~120m shares worth ~$360m.

Chemist Warehouse was a foundation tenant of David Di Pilla’s original Home Consortium platform before HMC evolved into today’s alternatives manager. Chemist Warehouse connections have consistently supported HMC deals, helping seed funds across retail, healthcare, real estate and private equity. Now, it looks like Verrocchi is stepping up support for the head stock, and in doing so, could turn the tide for HMC.

As we highlighted when we bought the stock originally, and several times since, David Di Pilla (CEO) is an exceptional operator with plenty of skin in the game, roughly ~20%, and we do back him to turn things around.

- While there is no concrete evidence of improving fortunes, we think this latest development will have a meaningful impact on sentiment and may be the precursor to more of a sustained change of trend. Confidence in asset managers is very important, and we think this provides a much-needed boost of it.