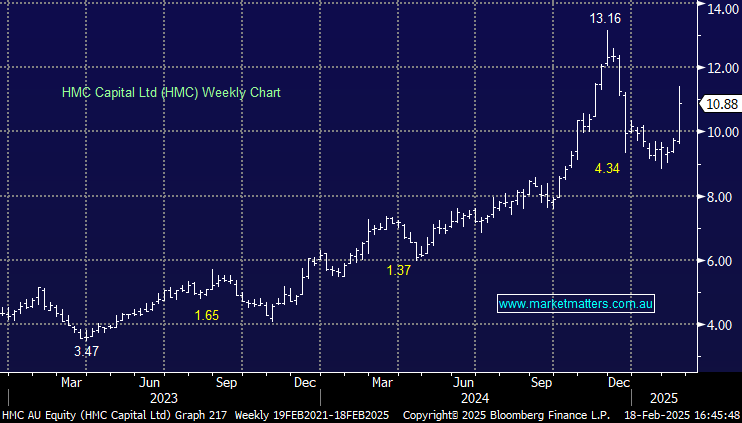

HMC +9.9%: Reported strong headline and underlying 1H25 results and a full-year earnings upgrade was the cherry on top.

- 1H25 revenue of $127.3mn, +68% y/y from $40.2m 1H24

- 1H25 pre-tax EPS was 51.9c, +204% y/y from 17.1c 1H24, consensus 37.4c.

- Full-year pre-tax EPS guidance up by 8% to 80.0c

- Fee-earning Assets Under Management (AUM) of $14.8bn,

Breaking down the result, management fees rose to $127m (vs $41m pcp) due to FUM growth in private credit and digital infrastructure. Performance fees of $3.3m were driven by Real Estate APS1 and US Digital Infra funds. We are conscious of the heavy tilt in revenue this half to transaction fees of $73mn which made up 58% of total fees. After a busy period, we temper our expectations for transaction revenue for the full year.

Despite this, the business has significant diversification, so if transaction revenue is to dip, we continue to expect revenue growth in all five key segments being real estate, energy transition, digital infrastructure, private credit and private equity.

- MM acquired HMC in the Emerging Companies Portfolio last Monday and will continue to hold it.