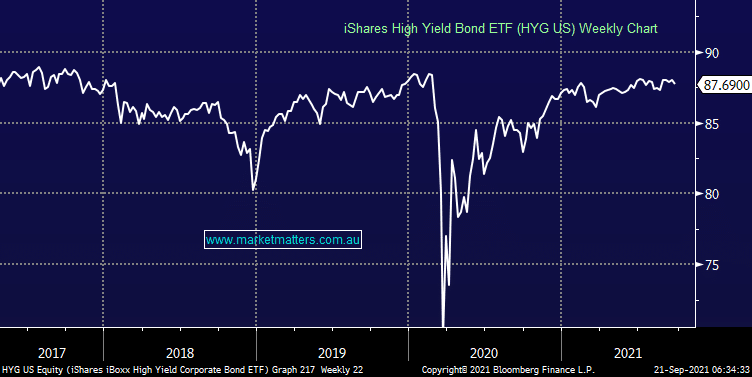

The weight of money globally sits in the bond market and it’s often described as the smart money while equities get tarred with the other side of that brush. While there are a number of concerns playing out in equity markets including seasonal weakness, the potential for a major Chinese property developer to collapse and another one this morning that gets rolled out whenever markets are soft, namely the US debt ceiling, we’re not seeing signs of panic in the high yield bond market, similar to the lack of panic shown through the Volatility Index it seems that ‘stickier money’ is not yet believing we are at the start of a deeper correction.

A few points worth reiterating:

- Liquidity seems fine with high yield or “Junk” bonds remaining solid and they are usually one of the 1st instruments dumped by truly nervous investors.

- Historically, buying any meaningful weakness in September reaps solid rewards for brave investors into the back end of the year.

- Fund managers have already moved down the risk curve with Augusts Bank of America survey showing cash levels at their highest level in over 12-months i.e. this money will be looking for a home into weakness.