HLO is a major player in Australian travel, though it doesn’t get the airtime of larger rival Flight Centre (FLT) and digitally focussed Webjet (WEB). Launched in 2013 after the consolidation of legacy brands Harvey World Travel, Travelscene, Jetset and Travelworld followed by merger with AOT in 2016, Helloworld Travel was born in 2017. It’s a $400m business, now growing earnings strongly and is priced at a material discount to the other more well-recognised brands.

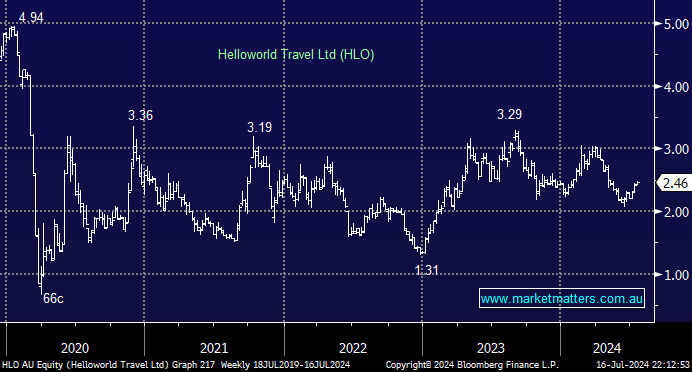

- Recent strength in ABS travel data prompted MM to revisit HLO, and with the shares trading towards the bottom end of their trading range, the time seems right to reconsider HLO.

ABS numbers for May showed a strong uptick in arrival and departure data, with arrivals up 14% from a year earlier, while departures were up nearly 15%. Provisional data for June implies the same sort of trend, which bodes very well for HLO. From a broader perspective, travel is a discretionary item where cost of living pressures have a negative impact, while the availability and cost of flights are also a key influence. While Australia is not where the US is in terms of interest rates, we are likely to be at some stage over the coming 12 months, providing important cost-of-living relief while airfares are also headed in the right direction (lower).

HLO will report FY24 results on August 23rd, with underlying profit expected to increase to $37m. Looking out to FY25, consensus has underlying profit increasing by another ~20%. At 10.9x FY24 Est earnings, HLO is materially cheaper than FLT (23x). While it doesn’t have the scale of FLT, HLO is at an inflexion point for earnings.

- We like the tailwinds (pardon the pun) for HLO over the coming 12 months, adding the stock onto our Hitlist for the Emerging Companies Portfolio.