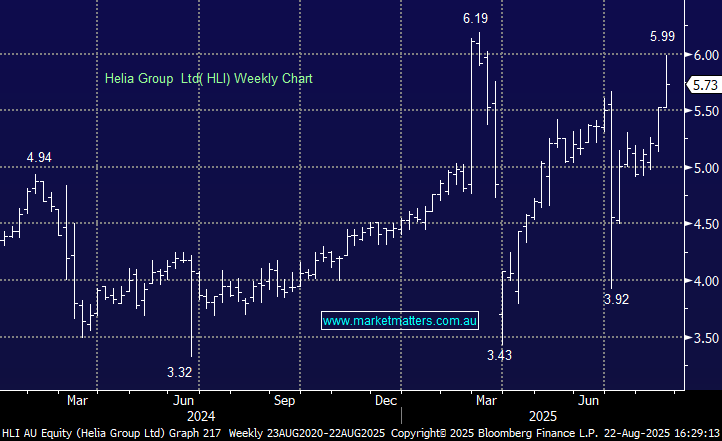

HLI +1.78%: Solid 1H25 earnings growth for HLI on higher gross written premiums, though total insurance revenue was softer.

- Net income rose 38% y/y to $133.7 million

- Insurance revenue fell -6.5% y/y to $182.2 million

- Gross written premiums grew 28% y/y to $109.9 million

- Interim dividend of 16 cps and special dividend of 27cps.

Helia narrowed its FY25 insurance revenue forecast to $350–390million as the Federal Government’s expanded Home Guarantee Scheme creates challenges for the LMI sector. With First Home Buyers already 25–30% of GWP, policy-driven substitution could pressure growth.

Despite potential government-driven pressures on the business, we own HLI for yield in the Active Income portfolio, and the dividends announced are attractive ~7.5% at current levels.