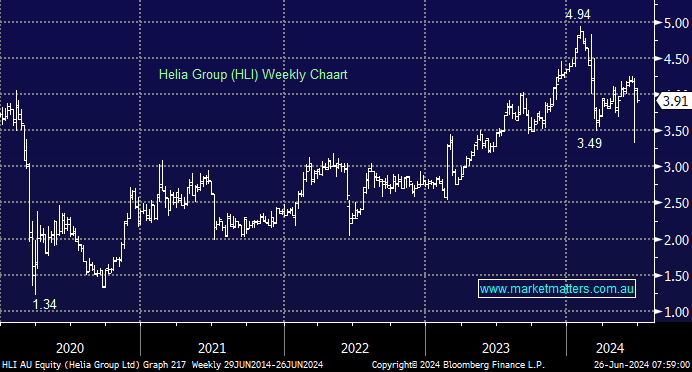

The mortgage insurer previously called Genworth has been on our Hitlist for the Income Portfolio for a few months, and last week it sold off aggressively for a day, only to bounce back the next. We did answer a question about the company last week, however, we think it’s worth re-summarising our view. The sell-off related to an announcement by CBA, their largest customer which accounts for 53% of their Gross Written Premium (GWP), putting their (CBA’s) total Lenders Mortgage Insurance (LMI) business up for tender. At the moment, HLI has most of it, but not all (QBE has some). The tender happens at the end of 2025, and HLI might lose the contract entirely, or they might win all of CBA’s business – it’s hard to know.

- In a situation like this, we need to asses what both scenarios look like. Winning the business would be a positive to earnings and a positive to the share price, but it’s some way off and the alternative might happen, so what does HLI look like if they lose the business?

The impact of any loss would be felt mostly in 2027 given the nature of the business. Providing LMI requires capital, so when less LMI is written, HLI would require less capital, some of which would come back to shareholders via capital management, offsetting the loss of earnings as their book goes partially into run off. Capital management would involve more aggressive buy-backs and other initiatives. Macquarie values HLI’s current policies + future profits from them at $5.32 (including the current CBA business), and then applies a discount to get their 12 months target price of $3.90, which they kept unchanged last week.

In essence, if they lose the contract, it will be mostly offset by capital management, and if they win all the CBA business, it will be net positive. It was a knee jerk reaction from the market when this was announced last week, and we should have been quicker taking this opportunity given the stock resides on the Hitlist of our Income Portfolio.

- We think the stock is a hold ~$3.90, but a buy into any more headline driven weakness, supported by an ~8% yield and ongoing share buy-backs.