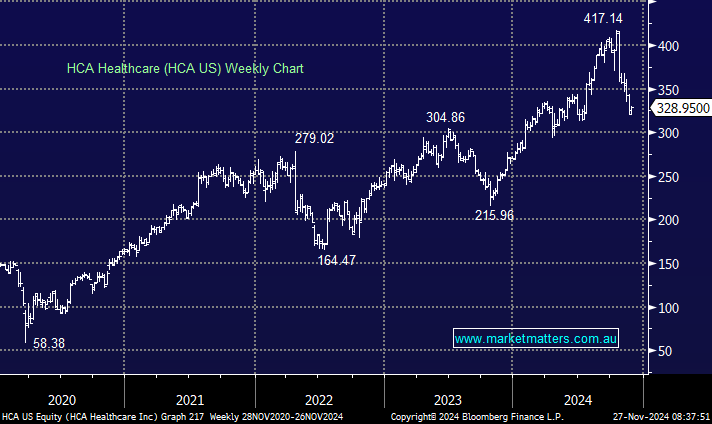

We’ve owed HCA Healthcare multiple times in recent years, and it has been good to us – our last trade locked in a 70% return in ~10 months. Since we took profit in September, the stock has pulled back ~20% and is starting to look interesting again. The type of business that HCA operates (hospitals and day clinics) is fairly consistent over time, however, the stock has been priced on a low of 11.4x earnings and a high of 17x earnings, as different outlooks play into market positioning.

- HCA currently trades on 13.3x, which is back to its 5-year average.

As the above chart highlights, the stock is neither cheap nor expensive and being patient with more protracted weakness has served us well in the past. The Republican clean sweep has recently cast a shadow over the sector, hence the pull-back in price, with the prospect that enhanced exchange subsidies will expire along with a greater level of uncertainty from a broader policy standpoint in an area (healthcare) that now sees Robert F Kennedy at the helm. In this environment, we think the sector should trade on a below-average multiple relative to today’s ‘average’ valuation.

- HCA Healthcare is more attractive now than it was, although we think the PE re-rate has further to run given the uncertainties surrounding health policy from 2025 onwards.