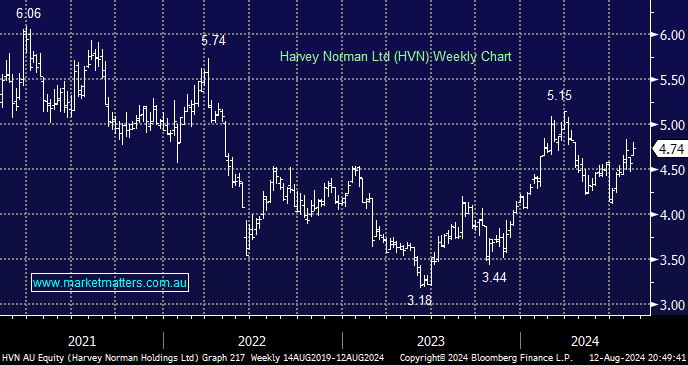

HVN has outperformed the ASX200 so far this year, but if we slip into a recession, it’s likely to be one of the sector’s major victims. We can see fresh 2024 highs into Christmas, but the risk/reward isn’t appealing around $4.75. The stock is trading on the mildly expensive side, though if we get rate cuts for the right reasons, the outlook for discretionary spending, plus their all-important property portfolio will improve materially.

NB HVN will report on August 30th; its performance relative to JBH in July will be of particular interest.

- We prefer JBH to HVN, with big-ticket items at HVN more dependent on the economy and people’s savings.