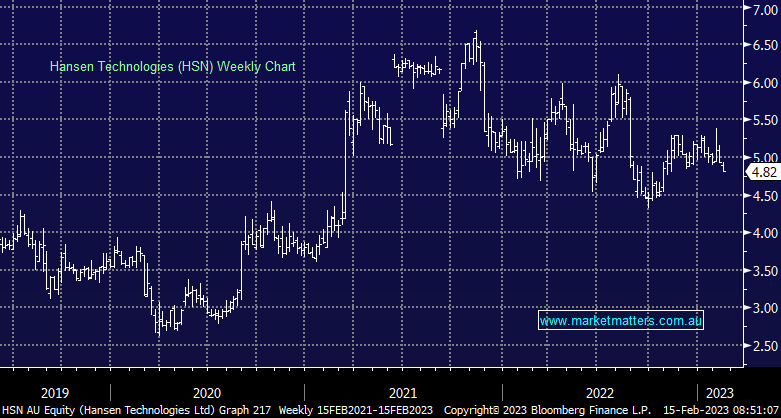

The billing software provider has fallen ~10% over the last few weeks, catching our eye ahead of their 1H results next week. The company has strong defensive qualities with their technology used in telecommunication and utility provider systems globally, historically seeing low levels of churn, strong cashflow generation and the ability to pass on inflation-linked price increases. They also have a solid M&A track record and a significant war chest to go after accretive acquisitions with such a strong balance sheet. Shares have been in no man’s land since BGH walked from takeover talks last year, however, the company has proven there are no skeletons in the closet and contract wins are coming through. We expect to see earnings grow from FY24 onwards, with near-term upside in M&A likely to prove the stock is cheap on just 18x PE multiple i.e. this is a profitable tech company, not one burning cash!

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM is bullish HSN ~$4.80, adding it to the Emerging Companies Portfolio Hit List

Add To Hit List

In these Portfolios

Related Q&A

Steep falls in tech

Hanson Technologies (HSN) Update

AIC Mines (A1M) and Hansen Technolgies (HSN)

Hansen (HSN) looks cheap

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.