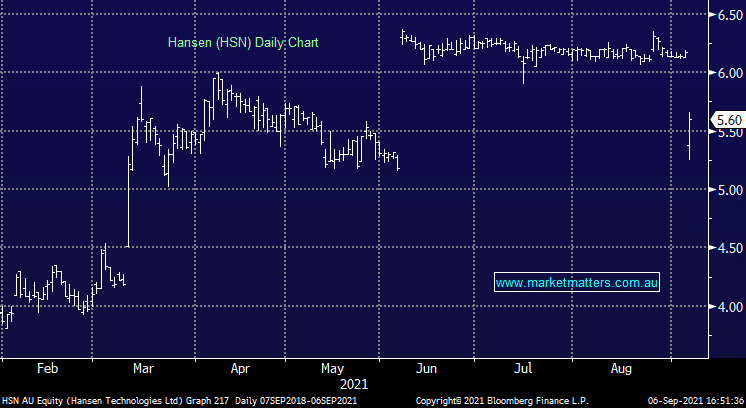

HSN -9.24%: the software company struggled today after BGH walked from takeover talks. The private equity group had offered $6.50/sh for the utility billing software business in early June, which was a 25% premium to the prior close. The deal has fallen through following 3 months of due diligence, though the bidder did not cite a reason as to why a binding offer didn’t come through. Hansen recently posted a strong FY21 result and have today maintained the FY25 target of $500m revenue. It looks cheap here, on less than 15x forecast EV/EBITDA, though I suspect there may be some wash out to come following this deal falling through.

scroll

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish HSN

Add To Hit List

In these Portfolios

Related Q&A

Steep falls in tech

Hanson Technologies (HSN) Update

AIC Mines (A1M) and Hansen Technolgies (HSN)

Hansen (HSN) looks cheap

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.