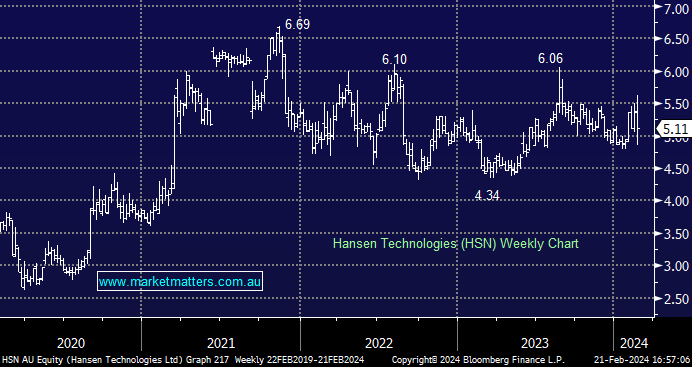

HSN -8.59%: a strong 1H for the billings software business but guidance weighed and shares were weaker as a result. Operating revenue grew to $168m, around a 5% beat while EBITDA of $52m was marginally ahead of consensus. Hansen’s latest acquisition, powercloud, helped support the top line, however, it looks to be weighing on the groups margin outlook near term. Hansen also left distribution guidance unchanged where the market was looking for an upgrade despite its strong balance sheet.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM is neutral HSN for now

Add To Hit List

In these Portfolios

Related Q&A

Steep falls in tech

Hanson Technologies (HSN) Update

AIC Mines (A1M) and Hansen Technolgies (HSN)

Hansen (HSN) looks cheap

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.