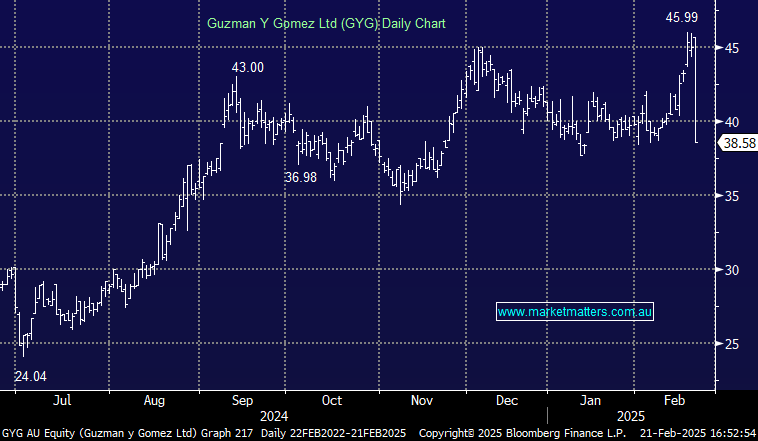

GYG –14.25%: Hit today on lower restaurant margins which weighed slightly on earnings;

- 1H25 Network sales $577.9 million

- Revenue $212.4 million (inline with exp)

- Earnings (Ebitda) of $31.6 million, +67% y/y which was a ~3% miss to consensus.

They said they expect to exceed FY25 NPAT prospectus forecast based on the strong progress made in the half. Medium term Growth looks solid with 103 restaurant sites in the pipeline, and in the shorter term, the first 7 weeks of this period, sales growth has been above expectations at 12.2%.

- It’s nice to see a sell-off here in GYG, a stock we’d like to own at some point.