The premier Wall Street bank has held a substantial valuation premium over the past year, with the share price doubling from its 2023 low. The rally was underpinned by strong earnings growth and then amplified by the belief that pro-growth policies under the Trump administration would create a fertile backdrop for investment banks. Ultimately, we think that view still holds true and will come back into focus once we move past the tariff tantrum and reignite the ‘Animal Spirits’!

We expect Goldman Sachs to be among the biggest beneficiaries of a more balanced regulatory environment in the US, especially a likely change in regulatory attitudes toward the capital markets business. With broader market weakness, shares have been hit hard, with GS US now trading back to an average valuation, having been on the expensive side since early 2024.

- Goldman now trades on 11.2x FY25 earnings with those earnings still expected to grow at ~12%.

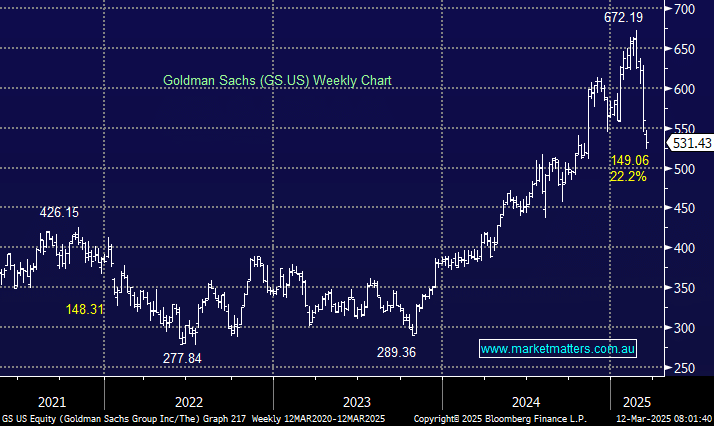

The share price pullback from the February high is over 20%, in line with other US Banks like Citi (C US), which also resides on the Hit List for the International Equities Portfolio. We only hold one banking exposure in this portfolio with a European tilt (UBS), which has held up better. We are keen to add a US-exposed bank in to the prevailing weakness, believing the risk/reward towards GS US is compelling around $US530.