Wednesday saw gold rise to a record high, after advancing by almost 1% in the previous session, as the opening salvos of the US-China trade war and ongoing Trump uncertainty underscored safe haven demand. Adding to the uncertain outlook, Trump proposing that the US take over the Gaza Strip and assuming responsibility for reconstructing the war-torn territory, during a press conference with Israeli Prime Minister Benjamin Netanyahu has left many thinking what next! The precious metal should benefit from increasing unease about what lies ahead, although it may lose some of its luster if interest rates stay high which could happen if tariffs push inflation up.

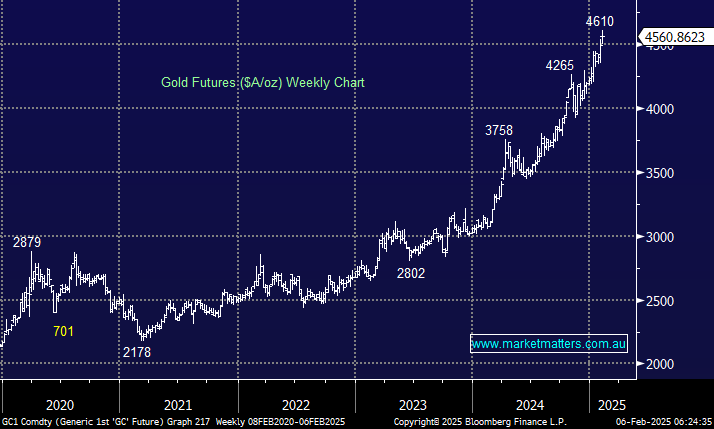

The $US Index fell overnight, extending losses following a US jobs report on Tuesday that pointed to a gradual slowdown in the labor market. A weaker greenback makes commodities like gold cheaper for most buyers. Gold continues to extend the last few years gains but we do caution that its been following MM’s road-map nicely and we see a 10-15% pullback looming on the horizon, plus its hard to imagine further improving tailwinds from here.

- We see gold testing higher this year, but the risk/reward is diminishing quickly.