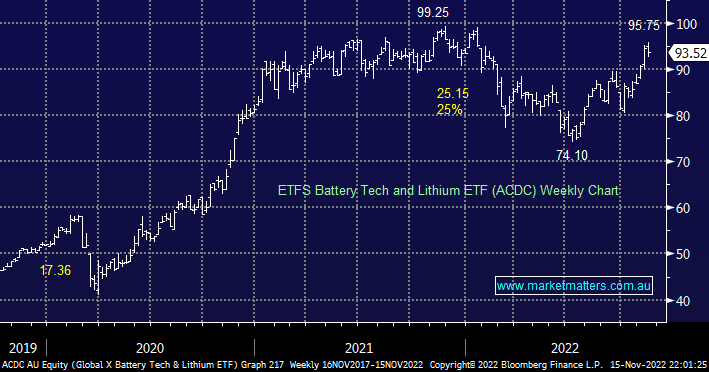

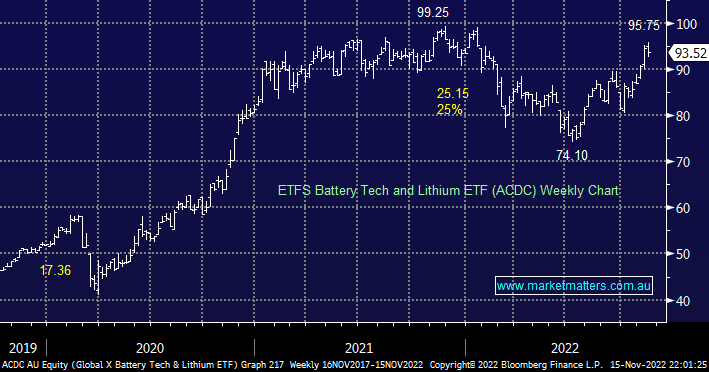

Following on from our previous comments around ESG positioning we felt it was prudent to touch on our ACDC ETF this morning. Clearly by its restrained rally through 2022 and relatively small pullback yesterday it doesn’t move in line with the high beta lithium stocks such as Pilbara (PLS) which fell -8.7%. Morgan Stanley put out a cautious note this week which caught the market’s attention and it did sound reasonable – it believes that “expectations are too high at the peak of the cycle and that the shares of one of the world’s largest producers – Sociedad Química y Minera (SQM) will underperform when the lithium price starts to fall in 2023.”

- We remain bullish on the ACDC looking for a test of the 100 area but obviously, this position is being monitored carefully after yesterday’s volatility.