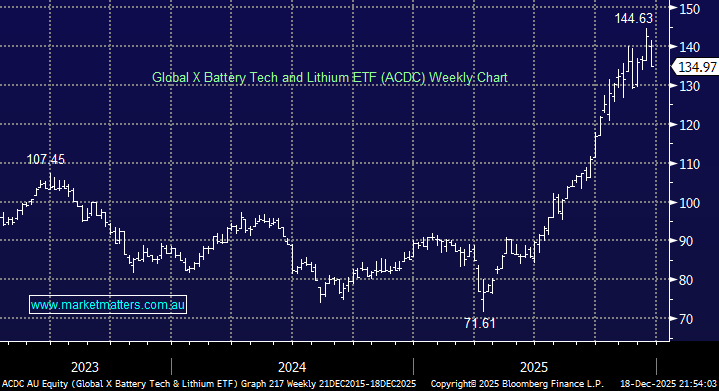

The lithium sector has also roared higher as the underlying battery metal traded back towards $US1,150/MT after testing $US600 earlier in the year, sparking short-covering and aggressive upgrades. The combination of the increased rate of EV purchases and increasingly bullish estimates of surging demand for battery storage due to AI has propelled the ACDC ETF up +53% in 2025.

In the short-term, the ETF and sector “looks & feels” stretched, and in our opinion, much in need of some consolidation with a pullback towards $120, our preferred scenario, or around 10% – but we note MM believes such a move, if it unfolds, will be a buying opportunity into a thematic that’s regaining some significant traction.

- We can see the bull market extending higher, but a pullback/period of consolidation feels overdue – this could take a few months, considering the advance has lasted around eight months.