The US S&P500 enjoyed its highest close overnight as traders weighed the impact of further Fed cuts on corporate America and valuations. On the sector level, the rate-sensitive consumer discretionary and real estate gained more than +1%, while energy was best on the ground, advancing +1.3%, similar to the ASX on Monday.

- We remain bullish while the 5600 area holds firm, with a break of the psychological 6000 insight before Christmas.

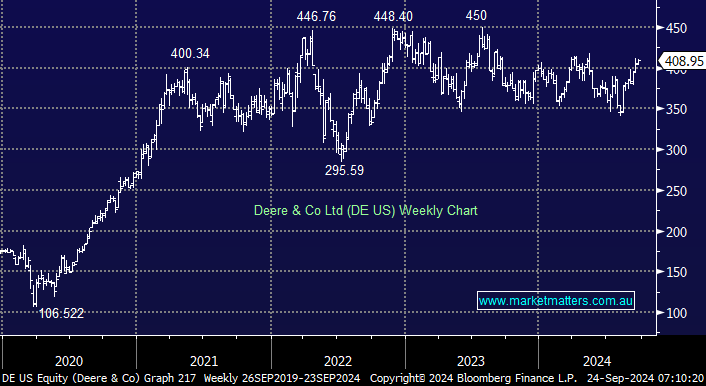

Overnight, former President Donald Trump threatened to impose steep tariffs on US farm machinery maker Deere & Co. if the company moved production to Mexico during an event on American farmers and trade – “I’m just notifying John Deere right now, if you do that, we’re putting a 200% tariff on everything that you want to sell into the United States,” Trump said Monday. This was classic electioneering, and the stock’s advance overnight dismissed his comments as just that, but tariffs, in general, and global trade are likely to impact many companies if Trump does win come November.

- We still feel Kamala Harris will likely win the election, which makes Trump’s threats just that, but it’s close.