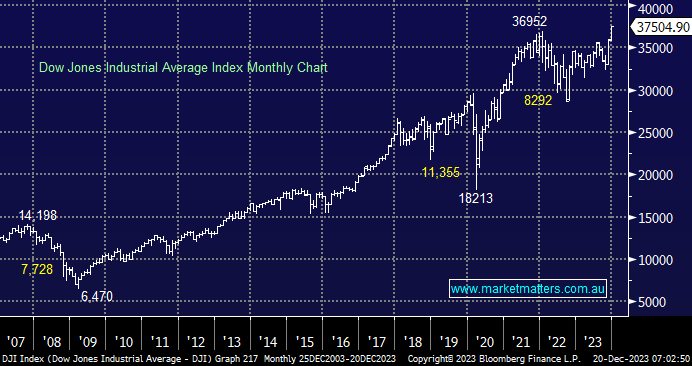

US indices pushed higher on Tuesday night as bullish investors shrugged off cautionary comments out of the Fed, i.e. The Atlanta Fed President predicted the US central bank would only cut twice in 2024 as opposed to the five times that the markets expecting – somewhere between the two seems the most likely outcome. Overall, the cycle of rate cuts is good for equities, but it does feel that many investors are getting overly optimistic towards the macro landscape for next year.

- We can see US stocks continuing to squeeze higher through this historically bullish period.

- However, we are a little concerned that 2024 could prove tough/volatile for investors with so much good news already baked in the proverbial cake.

US bond yields have turned sharply lower since late October, and MM can still see the 10s below 3.5% into January, but we are conscious that they’ve already corrected over 70% towards our target area and are starting to look stretched short-term. Lower yields are bullish equities and vice versa; hence, the risk/reward towards stocks is slowly diminishing for MM as yields approach our target.

- No change; we can see the US 2s testing 3.5% into January, but a snapback is becoming an increasing concern.