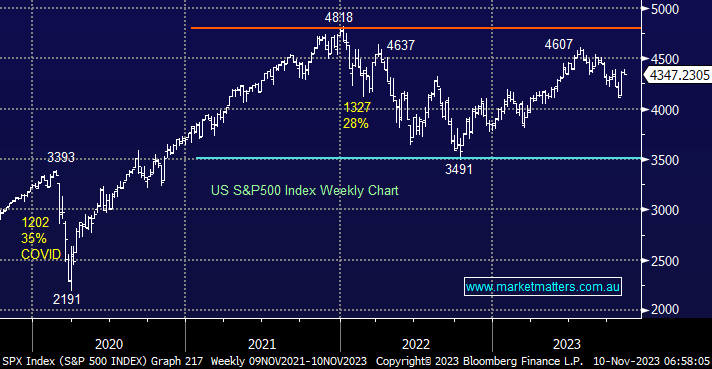

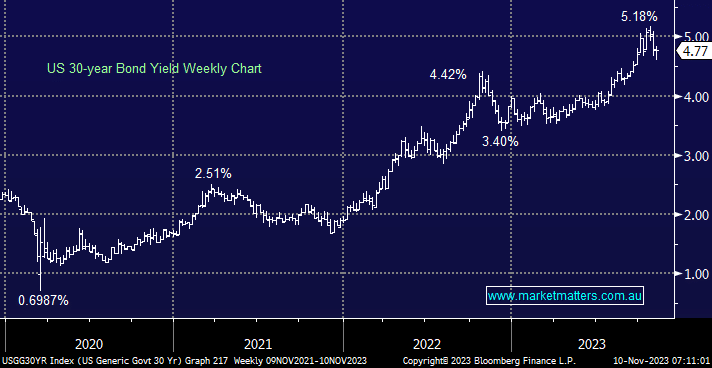

US stocks fell overnight, for the first time in nine sessions, after Jerome Powell delivered a surprisingly hawkish statement to a market looking for rate cuts by next June. Bond yields spiked higher on a combination of his comments and a weak treasury auction, which saw yields on the 30s spike 22 basis points – investors want a better return from US bonds at this stage of the cycle as they increase their issuance. Two other officials said the economy still hasn’t seen the full impact of rate hikes, which we felt was a more balanced stance on where the economy is positioned – capital markets are currently placing the odds of a soft landing at ~2x higher than a recession.

Two stocks we own in the International Equities Portfolio reported overnight, YETI Holdings (YETI US) was solid but not spectacular with the stock dropping -0.66% while The Trade Desk (TTD US) reported aftermarket, with a stronger than expected 3Q offset by weaker guidance. The shares were down 2.5% ahead of the result and have fallen further in after-hours trade. Elsewhere, Disney (DIS US) shares rose 7% after beating profit expectations, and MGM Resorts dipped ~2% even after delivering strong results and a new share buyback program.

- No change; we can see US stocks rallying into Christmas, although the easy money may already be behind us.

Bond yields spiked higher after the Fed Chair indicated that more work may be required to reduce inflation. We felt the comments were logical, but the market has been excited by the prospect of rate cuts in 2024. Interest rate volatility is currently dominating many markets as a pivot may be close at hand.

- We are looking for the US 30s to test initially below 4.5% over the coming months, but the Fed may hinder Christmas.