The US market took a hit following a night of disappointing earnings as investors weighed through the numbers to evaluate the strength of corporate America in the face of higher interest rates – heavyweights Microsoft (MSFT US) and Alphabet (GOOGL US) reported after the bell with both being decent beats. The standout losers were First Republic Bank (FRC US) -49%, General Motors (GM US) -4%. and UBS Group AG (UBS US) -4.7% while for the bulls PepsiCo Inc (PEP US) +2.2% beat expectations. Bonds rallied sending the US 2 years back under 4% as recession fears lifted in the wake of weak stocks.

- No change, from a risk/reward perspective we are now leaning towards selling strength as opposed to buying weakness as indices struggle around our target areas.

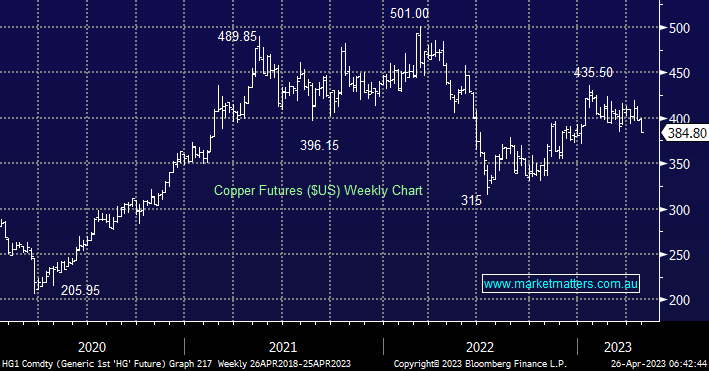

Copper tumbled -2.5% last night registering its lowest levels since early January in line with economic concerns while crude oil was not far behind closing down -2.4%. BHP fell over $1 (2.5%) in the US which looks set to lead the influential miners lower today not helped by the S&P500 Materials Sector which fell -2.2% overnight.

- History tells us that “Dr. Copper” is regarded as the bellwether for future economic strength hence the potential downside cannot be ignored.

We are now adopting a neutral stance towards copper shot term even while we like its outlook over the years ahead

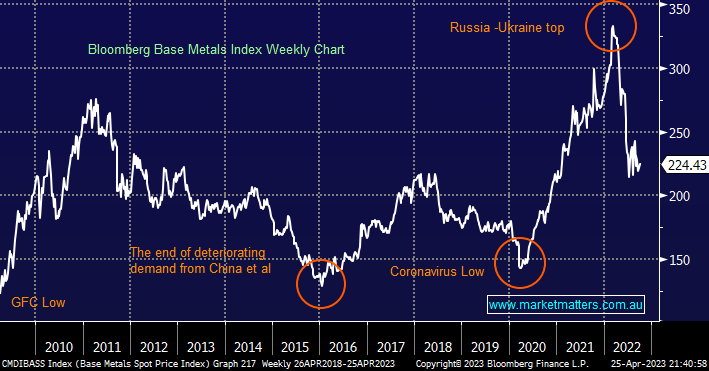

The overnight drop in copper highlights the significant weakness we’ve witnessed across the base metal space from the panic levels reached when Russia invaded Ukraine. Weighing up exactly how weak an economy is likely to become after interest rates have rocketed higher is largely guesswork, but fortunately at MM we are more focused on opportunities when sentiment swings too far which in this case could lead to buying opportunities in the quality miners – part of our current portfolio roadmap through 2023/4.

- We can easily see another 5-10% downside in base metals if recession fears gather momentum.