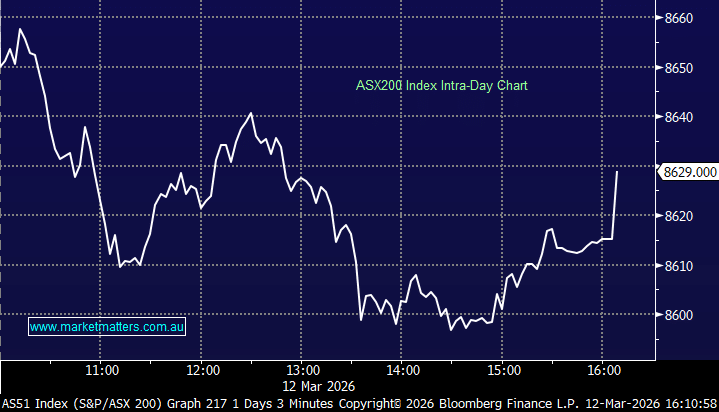

US stocks drifted lower overnight following strength in bond yields i.e. the same playbook as the last 12 months. The catalyst last night was a gauge for manufacturing improving for the 1st time in 6-months plus we saw measurements of prices paid also rising i.e. not indicators the Fed are hoping for.

- We believe tech stocks are holding in well with US 10’s trading around 4% but it’s a huge ask for them to rally while bonds remain weak (yields strong).

Strong economic data is continuing to weigh on bond prices (yields higher) but longer dated yields remain well below levels reached last October due to future recession worries.

- We don’t believe US longer dated yields will break clear of 4% as fear of a recession looms into 2024.