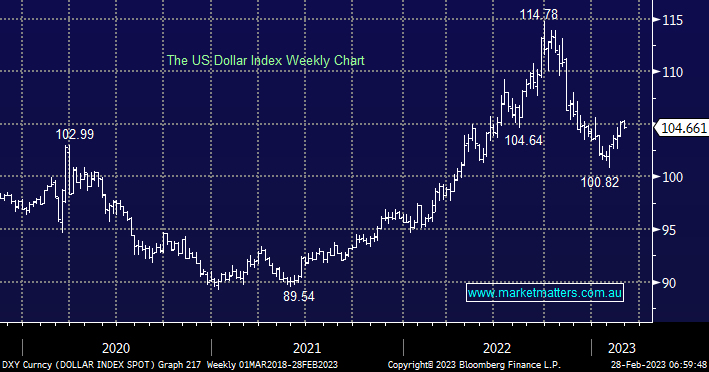

US stocks experienced another choppy session overnight recovering from their session lows as investors appeared to accept rates would be higher for longer i.e. nothing new at this stage although gains were dented by one Fed governor reiterating the central bank’s 2% inflation goal. US 2-year yield slipped back under 4.8% which saw the $US trade back below 105.

- Our preferred scenario remains the NASDAQ will eventually test over the 13,000 area, around ~8% away.

- In our opinion the relatively small correction as bond yields surged to fresh 16-year highs illustrates the strength in the sector at current levels.

The $US has bounced back to the 105 area which we’ve been targeting since January although bond yields have rallied sharper than we anticipated to support this move. In line with our preferred scenario of further choppy price action through March/April we now see the $US rotating quietly around 105 i.e. the “easy money” has been made by the bulls.

- Our preference is the $US will spend more time consolidating its weakness since September’22 before eventually breaking further lower i.e. this will be an ultimate tailwind for commodity prices.