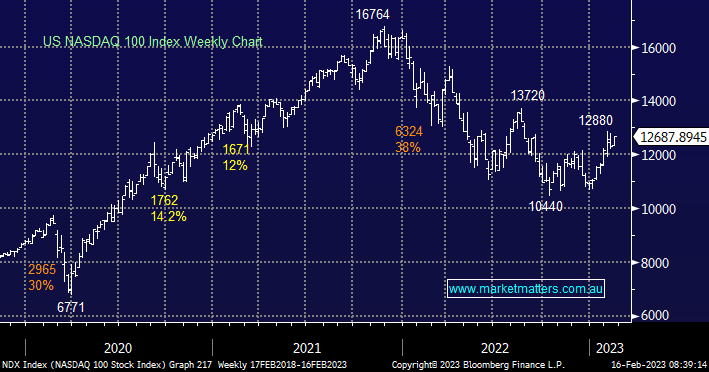

US tech stocks continue to rally even in the face of rising short-term bond yields which suggests an eventual Fed Cash Rate of ~5% is fully baked into today’s prices. MM is still overweight the sector although we are looking to take some profits into further strength.

- Our preferred scenario remains the NASDAQ 100 will eventually test the 13,500 area, around 6% above this morning’s close.

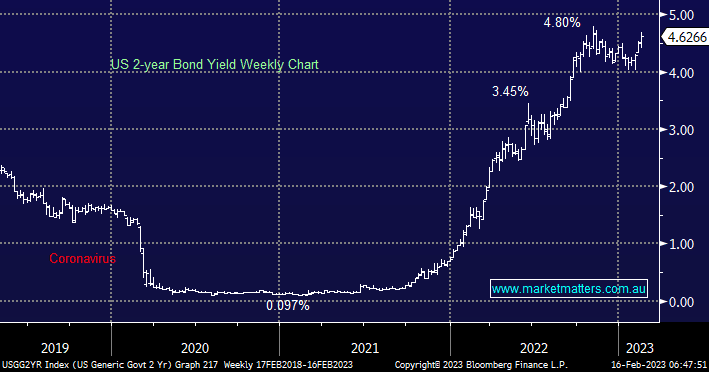

US bond yields have been rallying strongly since the combination of extremely strong employment and inflation data, the current solid economic backdrop looks set to take short-term US rates above 2022’s high, testing the 5% area in the process.

- We cannot ignore the current hawkish Fed rhetoric and strong economic data, short-term US yields look destined for 5%.