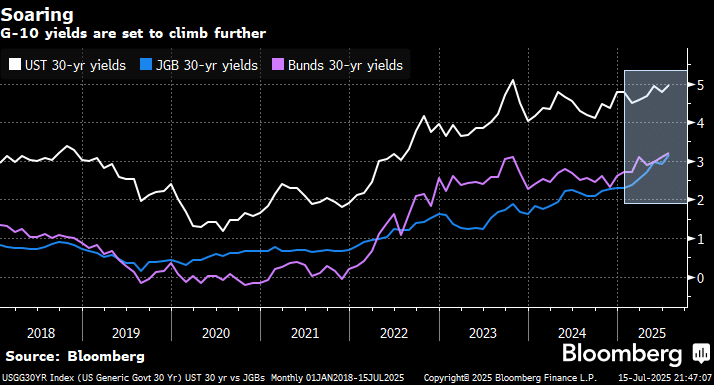

Yesterday saw Japanese 10-year Government bond yields rise to their highest level since 2008. The common characteristic across US, European, and Japanese long-term debt markets is that fiscal policy is carrying more weight than monetary policy in terms of determining yields. It’s a theme which started during COVID and hasn’t been dialled back since. Indeed, with many nations planning to boost defence spending, there won’t be respite, especially with tariffs likely to pressure inflation, with concerns about rampant government spending and widening budget deficits weighing on investor sentiment.

- In Germany, the yield on 30-year bunds hit a 14-year high as investors fretted about the combined impact of a surge in defence spending and, of course, tariffs directed at the EU.

- Overnight in the US, the 30-year Treasury yield climbed above 5% for the first time since early June, and there were large flows seen in options bets costing a combined premium of about $10 million that target a jump to around 5.3% within roughly five weeks.

- However, the biggest drama is arguably playing out in Tokyo, where the yield on Japan’s 30-year bonds has surged over the past week and is now at a two-month high, thanks to concerns that government spending will increase following an upper house election on July 20.

We’ve witnessed “bond tantrums” hit stocks in the past, and undoubtedly we will again in the future:

- In 2018 strong US wage growth sent the US 10-year yield up from ~2.4% to 2.9% and the S&P 500 tumbled ~10%.

- In 2022/3, the Fed began hiking rates. Yields soared from 1.5% to around 4.2%, and stocks corrected, with growth stocks being the hardest hit.

- In late 2023, the combination of fiscal concerns and strong data pushed the US 10s briefly above 5% and the S&P 500 fell away ~10%.

At this stage, we feel that long-dated bonds are the biggest threat to the entrenched equity bull market.