The childcare operator reported a solid FY23 result yesterday (December year-end) with $901m in revenue up 4% YoY and inline with expectations, dropping to a small beat in underlying earnings (EBIT) which was flat YoY at $80.3m – the dividend of 2c for the half was light on, however, that is expected to grow in FY23 (~5c) and add ~1c each year from there.

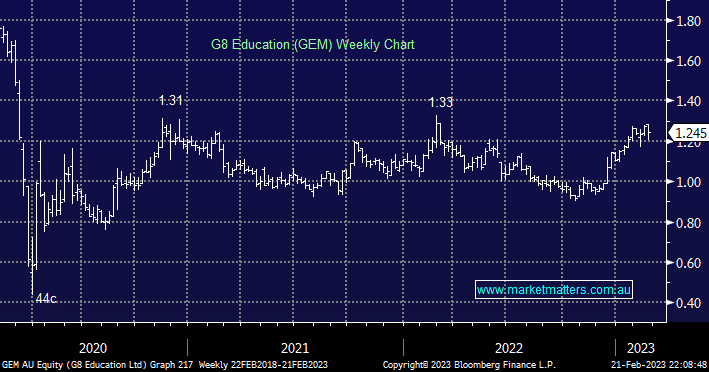

The shares were initially hit trading down ~6% before they ended 3% lower. We suspect the stock’s recent runup plays into this, with shares up ~40% from their October lows as investors started to see evidence that the turnaround was gaining traction. 2H23 occupancy was solid at 74.9% and the demand outlook remains good given the ‘Cheaper Child Care Bill’ which comes into play in July 2023. They managed to pull $14m of costs out of the business however labour issues are still bubbling away and unless there is meaningful improvement here, staff shortages will continue to cap occupancy at or around current levels, while it will be very interesting to see if this new Govt program incentivises more supply of centres.

In any case, we think GEM is now trading around fair value (Est PE of 13x) and is expected to yield 4% fully franked for FY23.