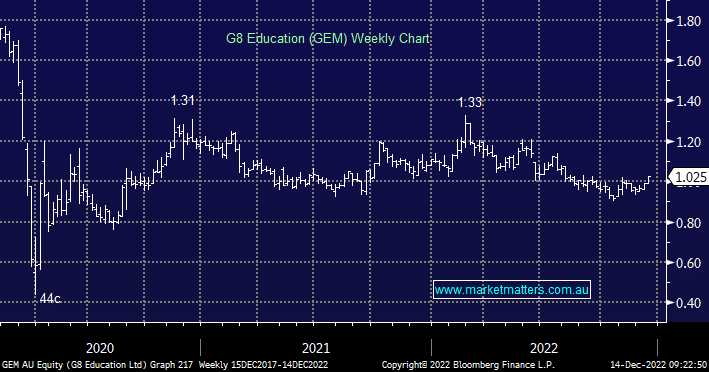

The childcare operator delivered a trading update yesterday that showed some swings and roundabouts as is expected in a turnaround story. The pros to the update were firmly around 2H momentum, with improving occupancy and strong enquiry levels evident, while they are running at $71m in earnings before interest & tax (EBIT) for the year (and should do at least $4m in Dec) meaning they will meet consensus expectations for the FY. The main con, however, is labour and a shortage of it which is starting to constrain the recovery. While there are things happening on this front, Governments could / should do more. In any case, GEM has rising occupancy levels, debt levels that remain flat for the year and not onerous, a relatively supportive Govt backdrop that is making it easier / cheaper for consumers to access childcare, a cost-out program on track, a relatively low P/E of 13x for FY23 dropping to 11x for FY24 while paying a dividend yield of 4.9% fully franked, while they also have another $8m of stock to buy-back.

scroll

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains optimistic on GEM’s turnaround

Add To Hit List

Related Q&A

Thoughts on TWE and GEM?

What does MM think of RVR & GEM?

Does MM like GEM moving forward?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.