What Matters Today in Markets: Listen Here each morning

The ASX200 closed unchanged yesterday which was a good performance with many market heavyweights such as BHP Group (BHP), RIO Tinto (RIO and CSL Ltd (CSL) all trading ex-dividend. Sector performance was very skewed as investors received their much-awaited income but the one group which again caught our attention on the upside was tech which is embracing the RBA’s dovish rhetoric and moves by companies to refocus their attention on profitability as opposed to simply growth at all costs – according to the AFR, over 125,000 local tech sector jobs have already been culled in 2023. All of a sudden several major tech stocks are outperforming the local index which is now only up +3.9% year to date:

- Tech Sector winners in 2023: Xero (XRO) +23.8%, WiseTech (WTC) +27.2%, Block Inc (SQ2) +27.4%, Technology One (TNE) +14.5% and Altium (ALU) +13.4%.

The speculative end of town also caught a significant bid on Thursday with both coal and lithium stocks enjoying stellar runs e.g. New Hope (NHC) +5.6%, Whitehaven (WHC) +5.6%, Pilbara (PLS) +4.4% and Liontown Resources (LTR) +4.3%. Conversely the ultimate of speculative beasts Bitcoin is suffering a tough time having already fallen -7% this week as it keys off the hawkish testimony from Jerome Powel and the Fed.

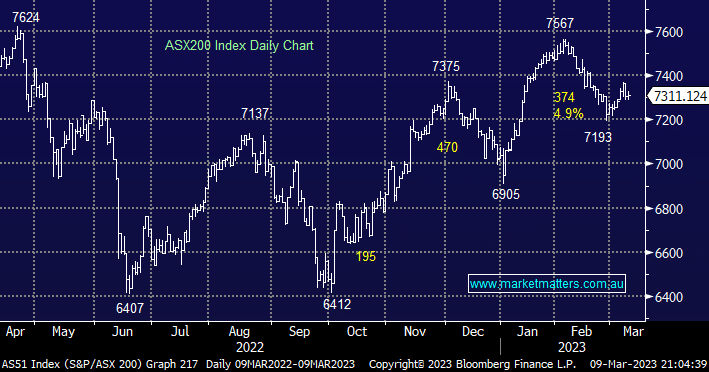

Another standout feature in our opinion yesterday was the simple general lack of selling across the market which was probably caused by a combination of relief following Philip Lowes’s dovish comments this week and the market’s apparent comfort around the 7300 area, however, history tells us that when markets “look & feel” comfortable it’s the most likely time for them to move! Following overnight weakness across US indices this morning will be another test of this “lack of selling” theory:

US stocks had a tough session overnight ahead of US Jobs Data and ongoing concerns following Jerome Powell’s extremely hawkish Senate testimony earlier in the week, the S&P500 closed down -1.85%. The SPI Futures are pointing to a -1.1% fall early this morning with BHP off 50c in the US while the banks had a tough night dragging the Financial Sector down -4.1%, not a good read-through for the ASX today.