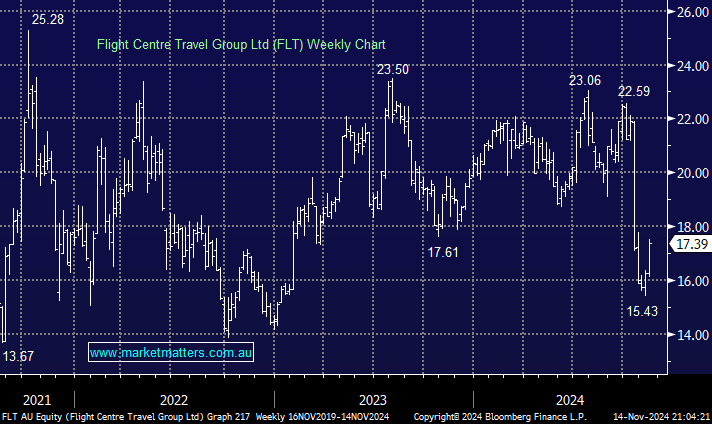

FLT advanced +4.6% on Thursday following its AGM. The company provided a trading update, highlighted growth in corporate transaction volumes, and emphasised short-term profitability—all very positive relative to its last update. At this stage, we believe the stock is showing glimmers of a turnaround, with international ticket growth +15% (4-months to October) and corporate volumes +3%. The challenge is now converting this to profitability.

- FLT guided to Profit Before Tax (PBT) in the range of $365-405m for FY25, with consensus currently sitting at $397m, a small downgrade at the mid-point, but it’s a wide spread!

The bounce felt justified following the AGM, with value certainly better than earlier in the year, but there are a few moving parts in this business and with the FLT Analysts very bullish, we’re comfortable with our neutral stance: 7 Holds, 5 Buys and 4 Strong Buys.